How to update Union Bank KYC Online New Process 2023

The KYC process is one of the most important things when it comes to the banking world. The ‘Know Your Customer’ process is mandatory for everyone. The know your customer that is KYC process is done to verify the customer’s identity by the banks or financial institutions. The customers of all the banks are supposed to periodically update their KYC. So if it’s been long since your last KYC update or if in case you have changed your address or name (mostly in cases of women after marriage) then you will have to do a re-KYC.

For re-KYC, you will have to submit a few documents. Most banks notify you with an SMS or Email if it’s been super long since your last KYC update. So if you are a customer of the Union bank of India then this process is paperless and easier for you. As the Union bank of India enables you to carry out the Know your Customer KYC process online. And you have to remember that if you do not update your KYC from time to time whenever it is due then chances are that your account might get blocked. And once your bank account gets blocked then you will not be able to do any transactions with your account.

So always update your KYC from time to time. So if you want to know how you can complete the know your customer KYC process online then read this article till the very end as we will be simplifying and breaking down the detailed step-by-step process for completing the know your customer process for the Union bank of India online. So just make sure that you follow all the steps given below.

Update Union Bank of India re-KYC online

Here is the detailed step-by-step process for carrying out the Know Your Customer that is KYC process for the Union bank of India online –

Step 1: Launch any browser and then go to the official website of the Union bank of India. Now go to the ‘Know Your Customer’ page. Now you will be able to see a lot of links on the right side of the screen. So scroll down and then click on the ‘Online Re KYC’ link.

Or click here to visit Union Bank Re-KYC => Union Bank of India Re-KYC Solution

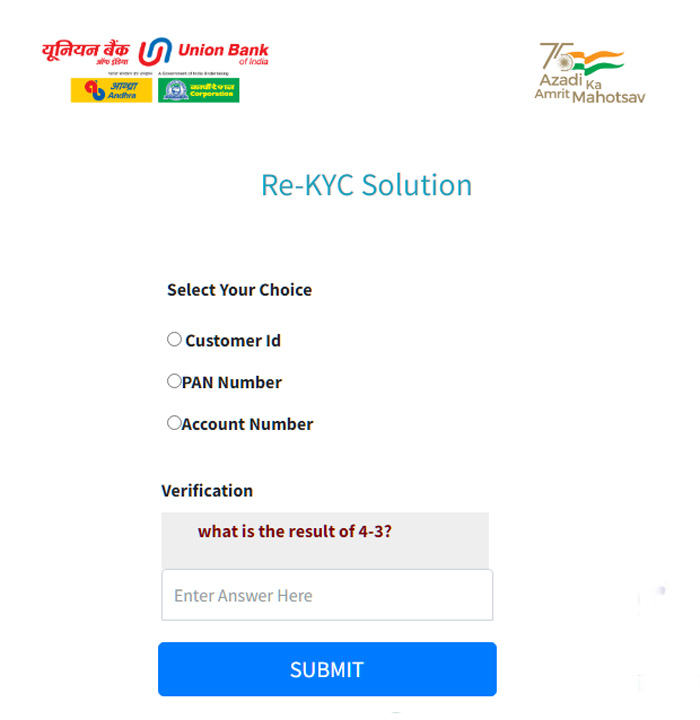

Step 2: Now once you click on the online re KYC, you will be redirected to the KYC page.

Step 3: Now to complete the further process you will get three options. The three options to complete the Know Your Customer process are as follows –

- By using your Customer ID

- By using your PAN Card Number

- By using your Account Number

So these are the three ways through which you can complete your KYC process. So you can choose any one option from the ones mentioned above. And once you are done doing this just click on the ‘Submit’ button.

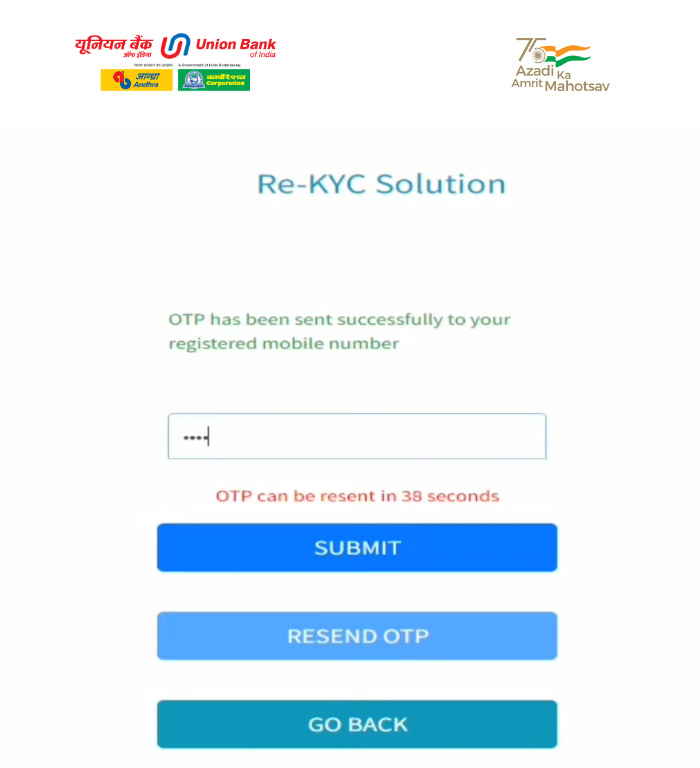

Step 4: Now you will receive an OTP on the mobile number that is linked and registered to your Union bank of India account. Enter the 6-digit OTP number that you have received and then click on the ‘Submit’ option. (This OTP will be valid for 3 minutes only)

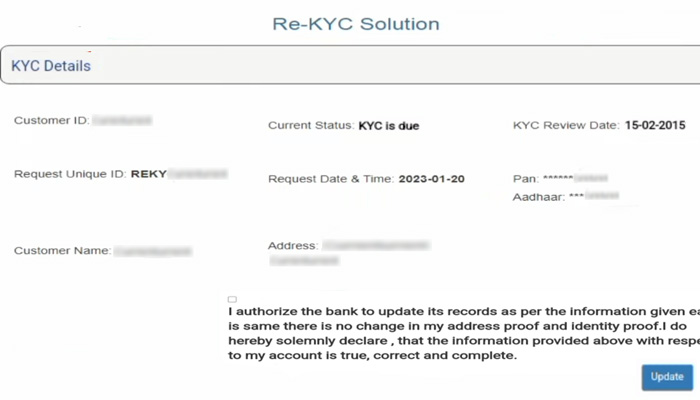

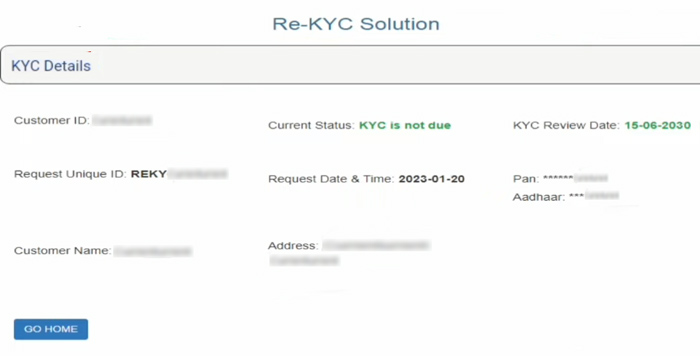

Step 5:. Now you will be able to see under the ‘Current Status’ if your KYC is due or not. If your KYC is due then check your PAN Card number, Aadhar card number, and other details as well. If you find that your KYC details such as Aadhar card number, PAN Card number, or anything else are wrong then make sure that you visit the nearest branch and submit the correct details.

Once you have submitted the correct details then revisit the same web page and then check if the mistakes have been corrected or not. If these details are correct then accept the terms and conditions by clicking on the check box and then clicking on the ‘Update’ button.

But if your KYC is not due then you do not have to do the further process as your KYC process is already up to date.

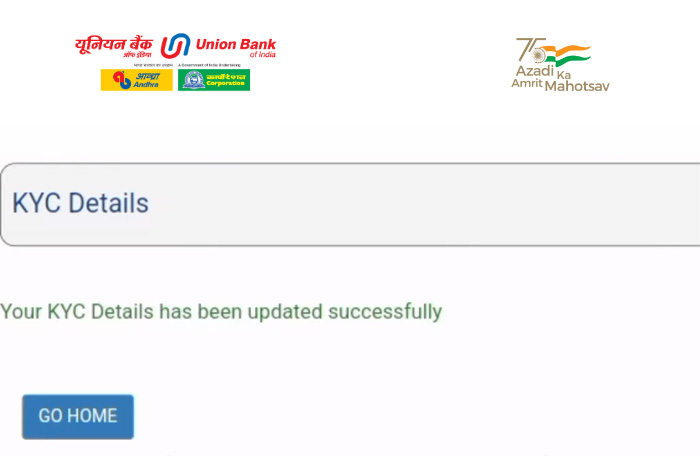

Once you click on the update option then you will be able to see that your KYC details have been updated successfully!

How to Check Union Bank of India KYC Status Online

Now if you want to see if your KYC has been updated or not then here’s how you can check it. Just follow the steps given below.

Here are the steps to check if your KYC has been successfully updated or not –

- Go to the official website of the Union Bank of India and then go to the KYC home page.

- Now you can enter your Customer ID or your PAN Card number or your Account number. So enter any detail which is available and then click on the ‘Submit’ button.

- Now you will receive an OTP on your registered mobile number. Enter that OTP and then click on the ‘Submit’ button.

Now under the ‘Current Status’ option, you will be able to see your cue status. So if it is shown as ‘KYC another Due’ then your KYC has been successfully updated. But if your current status is shown as ‘Your KYC is due’ then your KYC details were not updated. You will also be able to see the KYC review date. This review date shows the date for your next KYC updation.

So this is how you can update your KYC for the Union bank of India online. You do not even have to visit the branch. You can complete this process at any time and from anywhere. Just make sure that you follow all the steps mentioned above. And once you update your KYC details then also remember to check if your KYC details were updated or not. We have also covered how you can check the current status of your KYC and see if your KYC details updation process was successful or not. So this is how you can update your KYC for the Union bank of India online!