How to Register & Activate Canara Bank ai1 Mobile Banking App

Do you have an account in the Canara Bank? Are you having trouble activating mobile banking for Canara Bank? If your answer to the above questions was Yes then this article is for you!

In this article, we will be discussing the prerequisites and the detailed process to activate mobile banking for Canara Bank. So even if you have never used mobile banking before you will still be able to activate mobile banking after following the step-by-step process given in this article below. The mobile banking system has absolutely eased the lives of people, by saving them time, money, and extra effort. All you need is a smartphone and a stable internet connection. You have the entire bank in your control through a single mobile application. For Canara Bank specifically, the mobile application is called the Canara ai1 mobile banking app.

Firstly, you have to know the requirements or prerequisites for activating mobile banking for Canara bank. The prerequisites are as follows-

- You need a smartphone and a stable internet connection.

- You need sufficient balance to send SMS in order to pay carrier charges by the network provider or operator.

- Sufficient storage in your mobile phone to download the mobile banking application.

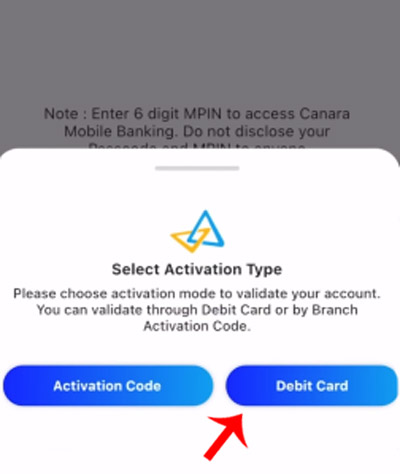

- The most important all is you need an active bank account and an active debit card for activating the mobile banking service. Or you will have to visit a branch for an activation code. Now before activating you will first have to register on the Canara ai1 mobile banking app.

How to register Canara Bank Mobile Banking App ai1

Here is the detailed step-by-step process to register for the mobile banking service for Canara Bank –

Step 1: Download the ‘Canara ai1’ app from the PlayStore or AppStore depending on the device that you use. (Make sure that you allow the permission that has been asked for)

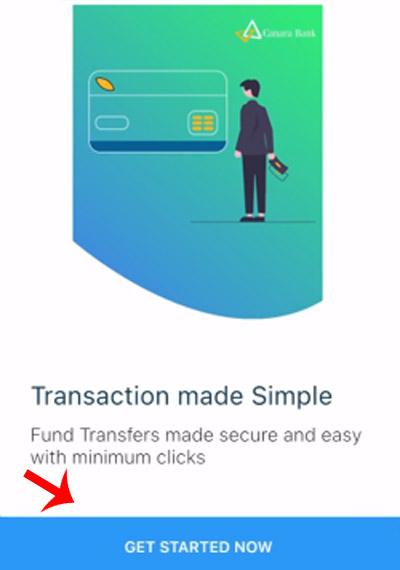

Step 2: Click on the ‘Get Started Now’ button.

Step 3: Now you will have to verify your mobile number. For that, you will have to select the SIM (mobile number) that is registered and linked to your bank account.

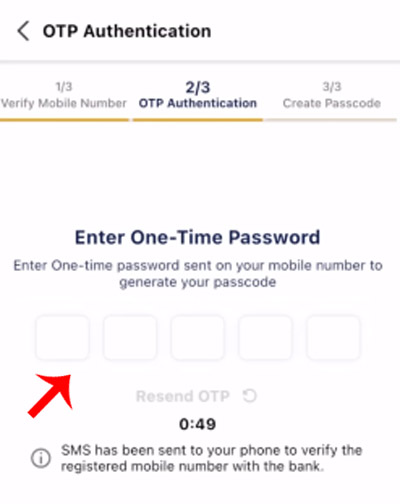

Step 4: You will then receive an OTP on your registered mobile number. Enter that OTP (In most cases the OTP will be automatically detected)

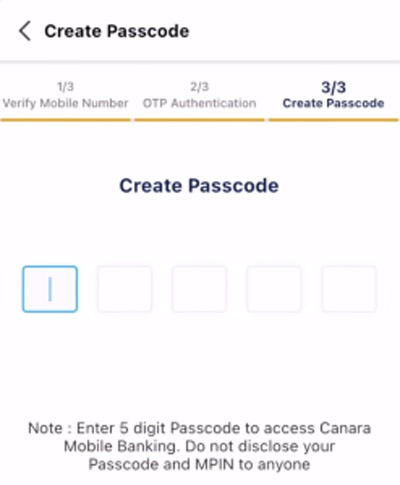

Step 5: Now you will have to create a 5-digit password and re-enter the same previously entered password for confirmation purposes.

Now, accept the terms and conditions by clicking on the ‘I agree’ option. You have registered successfully for the mobile banking service of Canara bank.

How to activate Canara Bank Mobile Banking App ai1

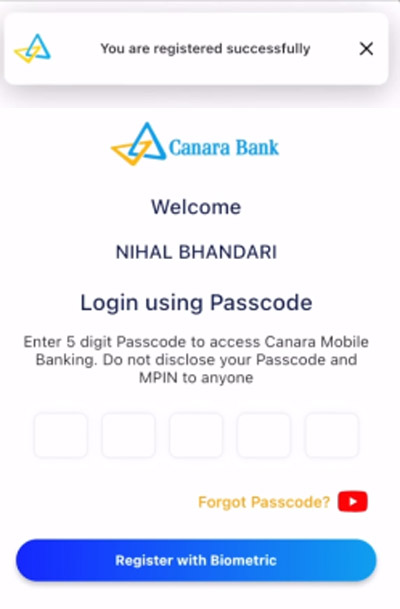

Now you have successfully registered on the Canara ai1 mobile banking app. But you will be able to use the mobile banking service of the Canara bank only once you activate it. (Registration is mandatory before activation). Now that you have successfully registered you can proceed to the next step which is an activation of the mobile banking service. Follow the steps given below to activate your mobile banking service for Canara bank. You will have to complete the activation process for using the mobile banking service of Canara bank.

Detailed step-by-step process to activate mobile banking service for Canara bank is as follows –

Step 1: Log in to the Canara ai1 mobile banking app. (Make sure that you have completed the registration process first)

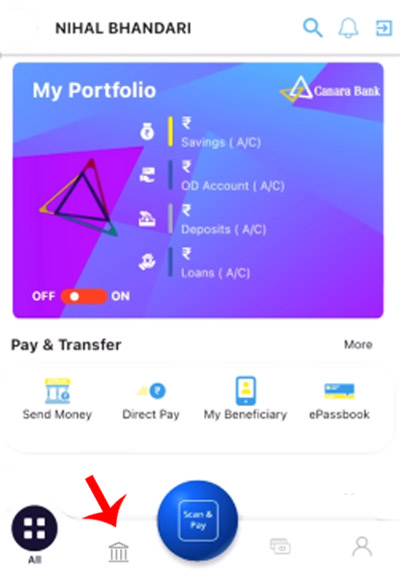

Step 2: You will be automatically redirected to the dashboard. Click on the ‘Home option’ present on the left side at bottom of your screen. (Note that the option is available in the symbol form)

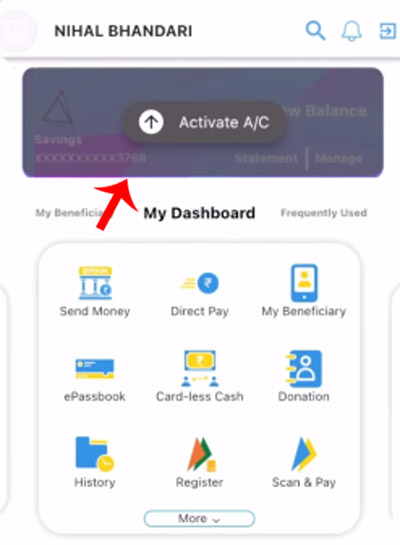

Step 3: Now an interface will be opened. Click on the ‘Activate now’ option. Now you will have to click on the ‘Activate Mobile banking services’

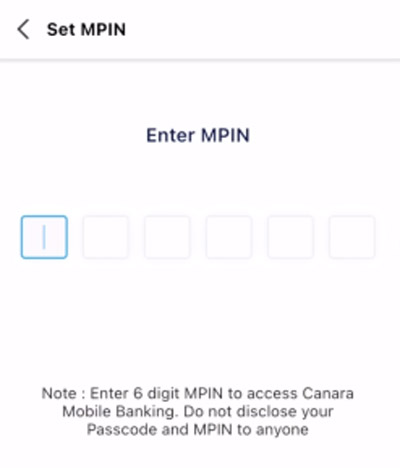

Step 4: Then you will have to create your six-digit MPIN. Re-enter the same MPIN that you created in the earlier step for confirmation purposes. And then click on the Confirm button.

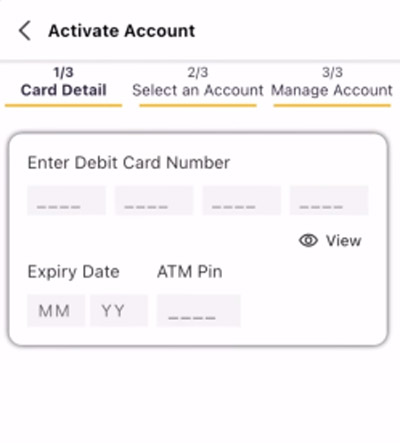

Step 5: Now under the select activation type, select the ‘Debit card’ option.

Step 6: You will now have to enter your debit card details like your debit card number, your debit card’s expiry date in the MM/YY format, and your ATM pin once you have correctly entered the details click on the ‘Submit’ option.

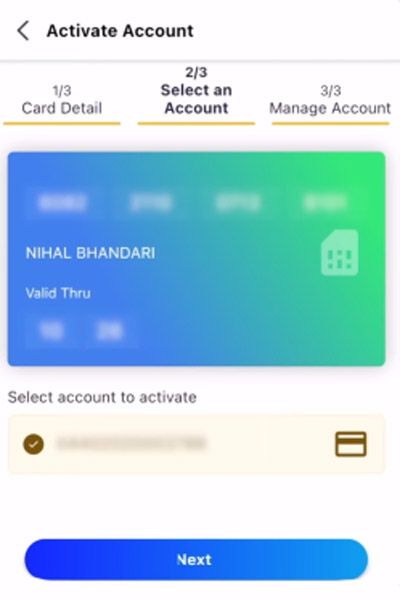

Step 7: Now an interface will open where you will have to verify your debit card details. If the details are correct then click on the ‘Next’ option.

And voila ! You have successfully activated mobile banking services for Canara bank.

So these are the steps to register and activate mobile banking services for Canara bank. Remember that you can use mobile banking and activate mobile banking services only by completing the registration process first. So make sure that you follow the detailed step-by-step process given above to complete the registration as well as the activation process.

Also when you create or set the MPIN make sure that it is a strong PIN code. Do not use numbers like 0000 and 1234 to prevent fraudulent activities. Immediately report any suspicious banking activity to your bank. If you suspect that you are in the middle of fraud, immediately turn off your data or wifi. Instantly block your card if a fraudulent transaction or activity takes place. Never click on any links or download any third-party applications since these can breach the security of your phone.

Also, make sure that you never give your details to anyone even if someone from the bank asks for details such as your ATM PIN. Banks never ask for your OTP or ATM PIN. For extra security, the layer enables multi-factor authentication and fingerprint lock to secure your mobile banking app. Make sure that you do not share the pin, password, or user name of your mobile application. Take care of the above-mentioned things to experience a more safe and more secure banking experience.