How to download a Filled Income Tax Return Copy Online?

We all know how important it is to have the right copies of the Income tax return after filling the Income tax return. To explain it in simpler words, an Income Tax Return (ITR) copy is a form which provides complete information about your total income tax and tax for a specific year and you have to sign the same with the Income Tax Department. The Income tax return acknowledgement receipt acts as an acknowledgement of you filing an Income tax return. This receipt is called as ITR – V. The ITR and the ITR – V is generated by the Income tax department against each e filed return without adding a digital signature.

How to Download Filed ITR Copy Online

Given below are the step for downloading the filed Income Tax return copy online :

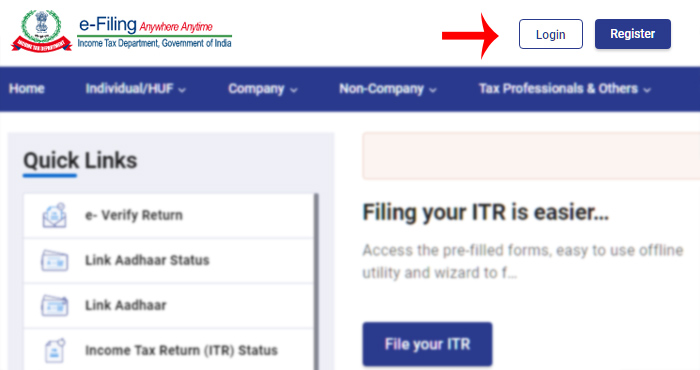

Step 1: Visit the official website of the Income Tax Department.

ITR official website => www.incometax.gov.in

Step 2: Click on ‘Login here’.

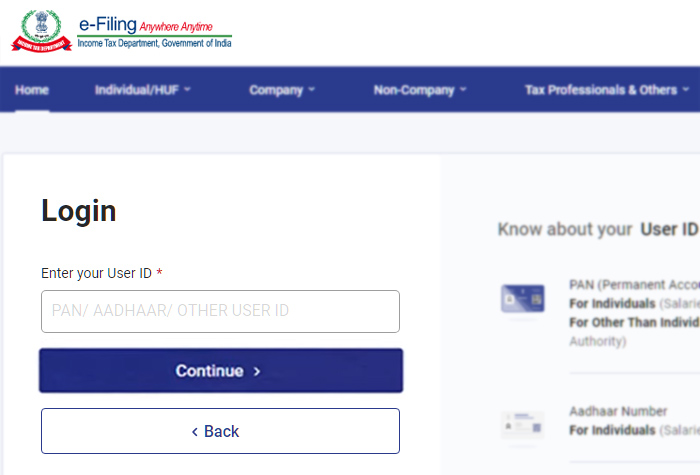

Step 3: You have to then enter your username, password and your security code to sign in.

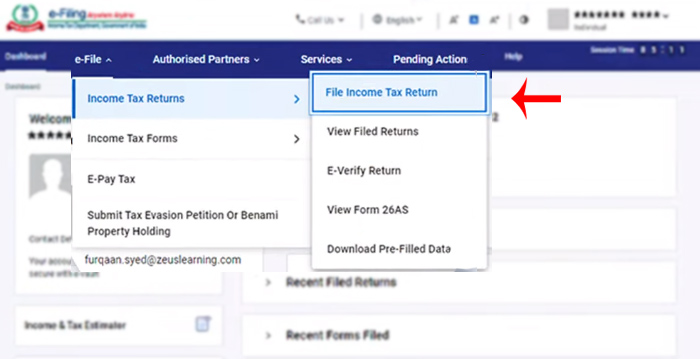

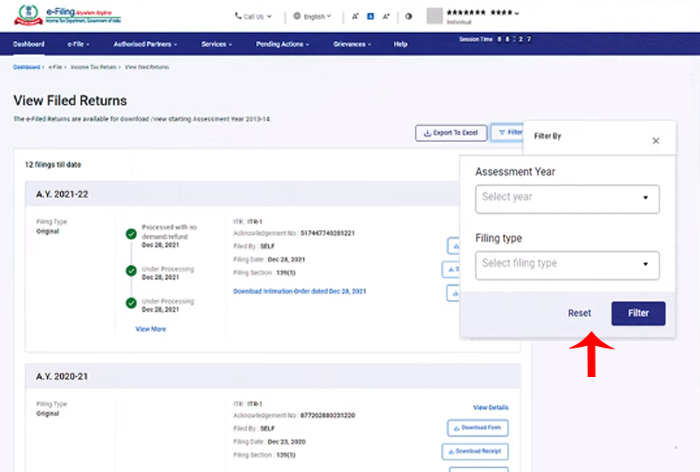

Step 4: Click on ‘File’. Then go to Income tax returns and select ‘View return forms’.

Step 5: Then select the year you want to download the Income Tax Return (ITR) for.

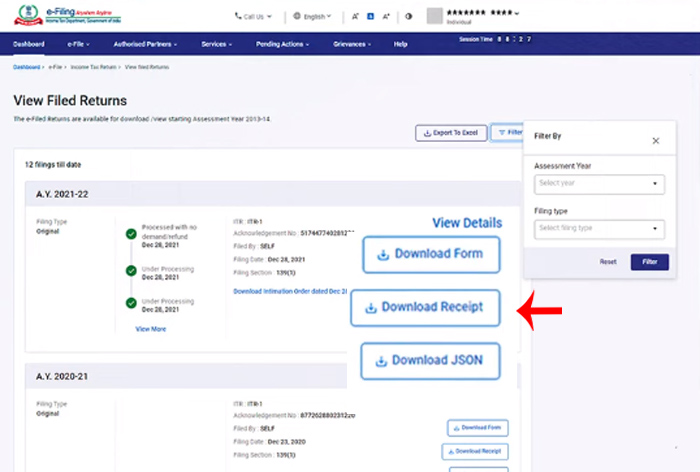

Step 6: Then click on ‘Download form’ for the Income Tax return and ITR – V.

Step 7: Then click on ‘Download receipt’ for acknowledgement.

And Voila ! You have successfully downloaded your filed Income Tax Return copy online.

Now you can download your Income tax return and ITR – V copies from the comfort of your home. Your ITR – V is sent to your registered email address by the IT department. So if this process seems difficult for you, you have another option to wait till your receive the email and then you can download it. You have to note that maintaining the Income Tax Return copy is super important. You have to maintain a systematic record of your Income Tax e – filings. This is important to all regardless of your profession.

But if you are an independent professional, an entrepreneur or even a freelance worker who does not have salary slips as income proof this still applies to you. So no matter what your profession is you have to maintain a record of your e – filings as this information always comes in handy as a proof of your income tax filings. It is one of the most crucial documents. If you apply for a loan you are asked to submit an ITR copy of the previous 3-4 years as an income proof before approving the loan. Also if you decide to go overseas, ITR copies are the only acceptable income proof documents for Visa. This document shows that you have the financial capability to return back to India. Since it is the most important document make sure to generate copies. Now that you have understood how to download the copies of ITR and ITR – V you can easily maintain a record of these copies. So follow the above steps to download the ITR and ITR – V copy instead of waiting for the email.