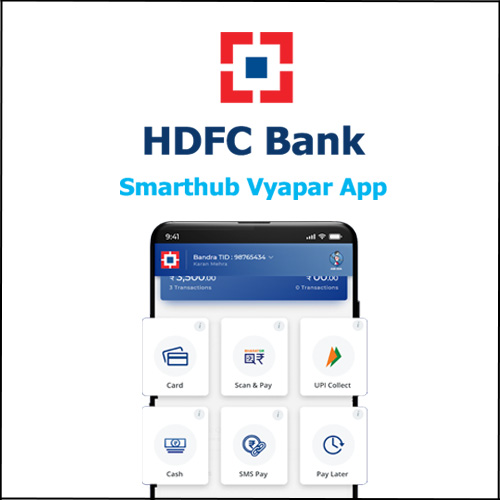

What is HDFC Bank SmartHub Vyapar? ! Here’s everything you should know about it

We all know that the HDFC bank is one of the most dominant bank in the banking sector. It never fails to enhance the customer experience. Now, HDFC has launched an app specially for merchants. So if you are a merchant this app is the solution to all your problems. If you want to grow your business digitally, this app is for you ! And this app will make your daily financial calculations so much easier. Now you must be wondering what is this app ? HDFC has launched ‘Smarthub Vyapar Merchant app’ specifically for merchants. The Smarthub Vyapar Merchant app is a comprehensive payments and banking solution specifically designed and developed to solve all the problems that merchants face everyday in their businesses. The HDFC bank Smarthub Vyapar offers facilities like instant, digital, and paperless onboarding experience to the existing HDFC bank current account holders. So you can take advantage of this app only if you have an active bank account in the HDFC bank. Also you can accept payments from all modes.

So to explain further payments across all modes include cards – tap and pay, UPI and QR codes as well. Merchants can now accept remote payments by just sending a payment link over the customer’s mobile number or email ID to facilitate non face to face payment collections. The one thing that the merchants are most worried about is due payments. But this problem can now be solved. The payments received through UPI will be instantly credited to the bank account to make sure that merchants get immediate access to the sales receipts. Sometimes merchants are scared to make online transactions as they are worried if they send or receive incorrect amount. Now with the HDFC bank’s Smart Vyapar app the merchants do not have to worry. This app has an inbuilt voice feature that informs the merchants of the transactions that have been completed and also gives the merchants voice based alerts and notifications throughout the transaction process.

How to register HDFC bank Smarthub Vyapar App

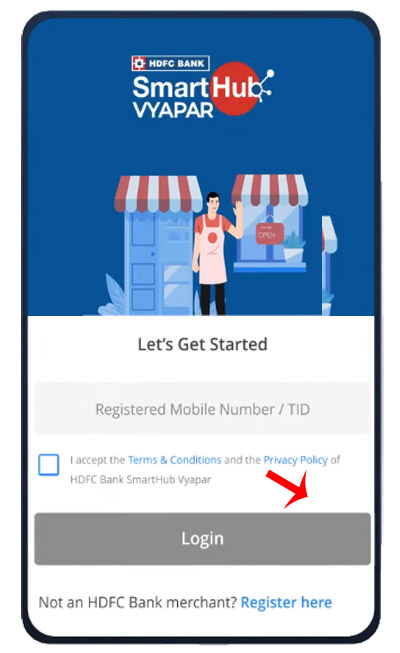

If you want to get onboard or register on the HDFC bank’s Smarthub Vyapar App then follow the steps given below –

Step 1: Download the ‘Smarthub Vyapar’ app from the playstore or AppStore depending on the device that you use.

Click on ‘Register here’.

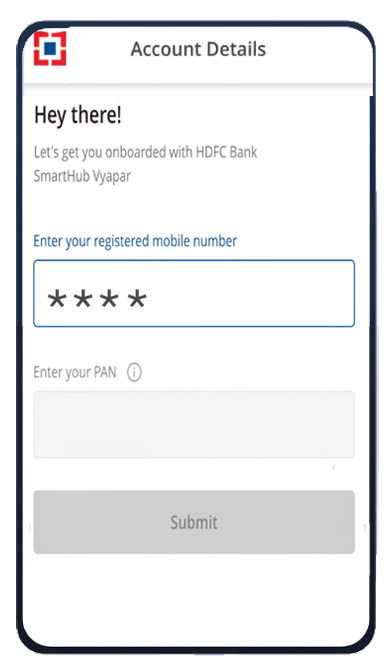

Step 2: Then you will have to enter your registered mobile number and your PAN Card number as well. Then click on the Submit button.

Step 3: Accept the terms and conditions by checking on the box. Then click on continue button.

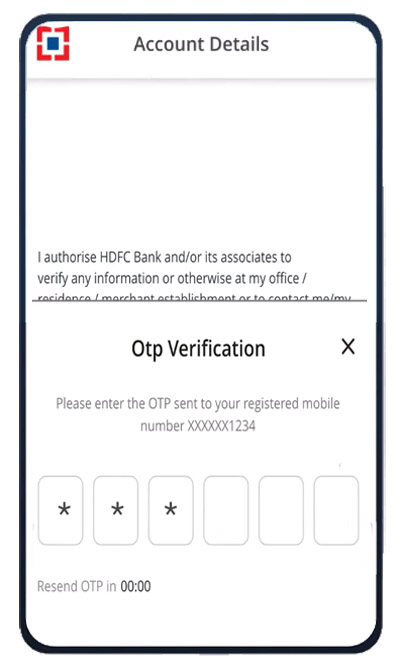

You will then receive a 6 digit OTP on your registered mobile number. Enter the sent OTP.

Step 4: Then enter your MPIN. You have to re enter your MPIN for confirmation. Then click on the next button.

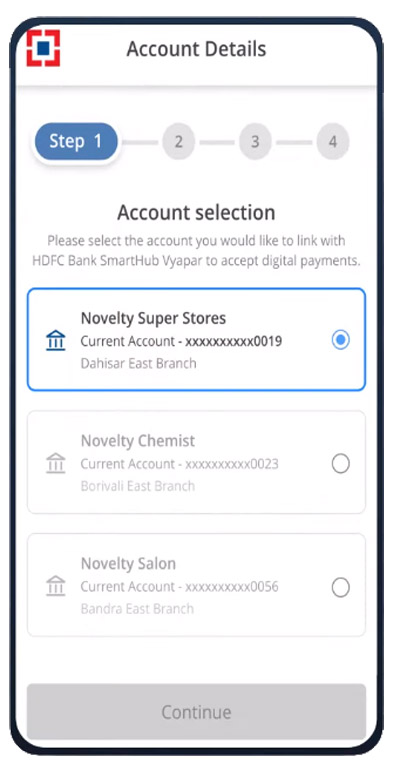

Select the bank account you want to link with the Smarthub Vyapar app and then click on continue button.

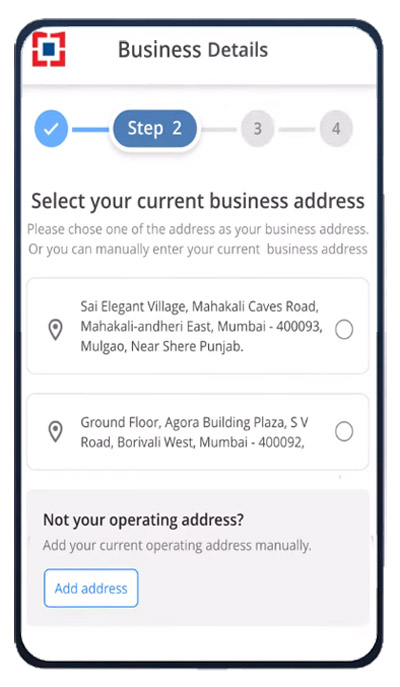

Step 5: Now you will have to select the address of your shop for QR delivery purposes. You will see the address already entered but if not you can type the address manually.

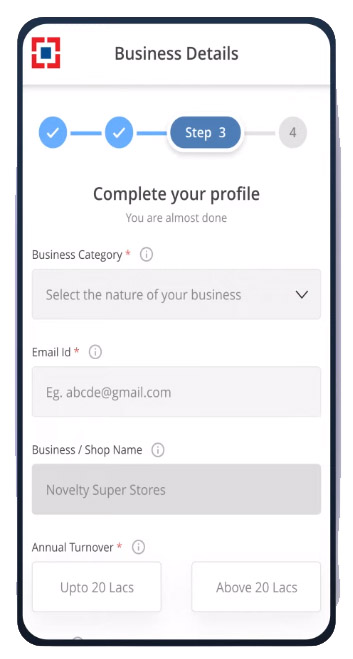

Step 6: Now you will have to choose your business category. Then enter your email ID.

You will then have to select your annual turnover. Then enter your GSTIN. And click on the continue button.

Now accept the MDR charges and click on the continue button. And you have successfully registered on the HDFC bank’s Smarthub Vyapar app !!

Once you have successfully registered on the Smarthub Vyapar app you will then have to activate and link your InstaQR to start accepting UPI payments immediately.

How to activate InstaQR

Here are the steps to link and activate your InstaQR –

- Click on Scan to activate QR.

- Then scan the InstaQR or the sticker to activate it.

- Click on the continue button.

- You will receive your personalised QR shortly.

- Click on the check box and accept the terms and conditions and then click on the continue button.

- Congratulations! You have successfully linked and activated your InstaQR and you are now onboard on the Smarthub Vyapar app !

Features of Smarthub Vyapar app

Let us now go through what are the key and main features of the Smarthub Vyapar app –

- The Smarthub Vyapar app enables the merchants to apply for fixed deposits and cards.

- It is also now easier to assign tasks and roles to the staff for example the cashier, manager etc with the help of the Smarthub Vyapar app.

- Also, merchants can now track, record and collect customer dues.

- The merchants can now offer the customers a pay later option with the help of the Smarthub Vyapar app.

- Also, the merchants will receive 24*7 support.

- Now merchants can offer customised deals to their customers with the help of ‘Customer intelligence and customer recognition’ features on the Smarthub Vyapar app.

- Not just banking but for marketing purposes the Smarthub Vyapar app offers the merchants creative campaign ideas for promotion through social media.

- Now you do not have to switch through multiple tabs as the Smarthub Vyapar app offers Biz view that is merchants can monitor business growth in one single dashboard.

- Easy reconciliations of all transactions and bank credits are now possible with the help of the Snarthub Vyapar app.

- This app also offers easy distributor and vendor payments that is upto 45 days of credit period via business credit cards.

- Now merchants do not even have to worry about loans as the Smarthub Vyapar app enables the merchants easy access to business loans, overdraft facilities and loan on their credit card as well.

- Also the voice notification feature is provided by the Smarthub Vyapar app on all transactions to reduce the transaction anxiety of merchants.

The Smarthub Vyapar prepaid card is also available. The smarthub vyapar prepaid card makes the payments at any retail stores more convenient and secure as well. The payments becomes super fast with the help of this prepaid card. One of the biggest benefit is that you can get upto Rs. 12,000 cash back per year, upto 1000 per month with minimum spend of Rs. 100 for online and offline spends and Rs 30 per month on utility payment with eligibility on maximum of 5 transactions every month. You have to note that in India the maximum limit of contact less payment is only Rs. 2000 that is you are only allowed to tap and pay the amount upto Rs 2000. If the amount is equal or more than Rs 2000 then you will have to enter your prepaid card pin. This is for security reasons only.

Features of Prepaid Smarthub Vyapar Card

The main features of the prepaid Smarthub Vyapar card are as follows-

- You can get 1% cash back on selected online and offline spends as well.

- This card enables you to get upto 5% cash back on utility payments as well.

- When you load your card for the first time, you will get a voucher of Rs 100.

- Also there are no charges on card issuance and you do not have to pay an annual fee as well of any sort.

- You can customize your card with the design you wish to have.

- The maximum balance for the Smarthub Vyapar prepaid card is Rs. 2,00,000. You can not exceed this number at any point of time.

- The Smarthub Vyapar prepaid card is widely accepted at all ATM’s, point of sales and all E commerce websites across India.

- You can also track all of your transactions using the ‘Prepaid net banking portal’.

- If you damage or lose your card or if your card gets stolen then you will receive a replacement card. The replacement card fees is Rs 200.

- Also, there are no charges for using the Smarthub Vyapar prepaid card at any merchant locations for shopping and at HDFC ATM’s but you will be charged at railway stations and petrol pumps.

The HDFC bank has taken a step to make business tasks easier for merchants and also are helping them grow their businesses. All sort of merchants from large scale to Kirana stores can take advantage of the Smarthub Vyapar app. The HDFC bank aims to empower this huge segment of vyaparis of our country. So if you are a merchant you should definitely check the Smarthub Vyapar app as this app has helped many merchants across our country to grow their business, solve problems in their day to day business and thereby being the solution to all of their problems.

FAQ

Do I need to have a HDFC bank account to use Smarthub Vyapar app ?

Yes. You should have an active HDFC bank account to get your hands on the Smarthub Vyapar app.

How to accept payments using the Smarthub Vyapar app ?

You can accept the payments via any mode for example through cards, QR scan and pay, UPI etc.

Do we get a physical standee of our QR code ?

Yes. The HDFC bank will send your a kit with your personalised QR code standee.

How to know if the payment is done successfully ?

You will receive a notification, also a voice alert and an In app notification as well once the payment is done successfully.

Can I disable the voice notification?

Yes. You can disable the voice notification on the Smarthub Vyapar app.

What is the maximum amount for business loan ?

The maximum amount for getting a business loan is Rs 75 lakhs.

What is a Business loan in just 10 sec ?

The HDFC bank offers a pre approved loan to selected customers through the Smarthub Vyapar app. The amount will be instantly credited into your account within the next 10 minutes.