How to Reactive: Union Bank of India Frozen/Blocked Account

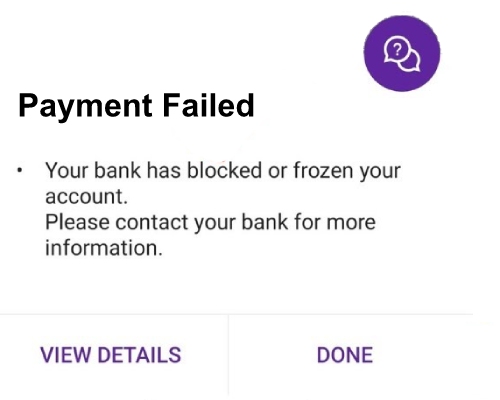

Sometimes our payments get declined and then we find out that our bank account has been frozen. The situation gets even worse when it’s an emergency. But some people wonder what exactly is a frozen bank account. To explain this in simple words we can say that whenever you can not take or transfer money out of your bank account it is frozen. There might be a lot of reasons behind your bank account being frozen.

Some common reasons are suspecting an unusual or fraudulent activity, an illegal activity, or even because of government orders. Sometimes having a frozen bank account might also mean that there might be a chance of being a victim of identity theft. When your account is frozen you will still receive deposits in it but you will not be allowed to make any withdrawals. Also whenever your account is frozen you will not be allowed to transfer money. You will have full access to your account but there will be limits and restrictions on what you can do.

Reasons 1

Let’s look at some of the most common reasons behind frozen or blocked bank accounts. The first and most common reason is suspected unusual or fraudulent activity. If any illegal or fraudulent activity is suspected or found on your account then your bank has full rights to freeze your account. Once they suspect any unusual activity or transaction they freeze or block your account. Once your account gets frozen or blocked you will not be able to make any transactions or payments of any sort.

You will still have access to your account but you will lose control. So if at this time you try to make a debt payment or an EMI payment then such payments will not go through. So you will have to verify the situation and try to reactivate your account.

Reasons 2

Bank account is frozen or blocked because of deliberately trying to write or cash out cheques

The second and one of the most common reasons behind a frozen or blocked bank account is if you write and cash bad checks. There are a lot of people who write cheques and try to cash them out even when they do not have that amount of money in their accounts. Such activities are not acceptable at all. You have to remember and many people are not aware of the fact that deliberately writing cheques for the amount that you do not have in your bank account and then trying to cash it out is considered fraud.

You might think that the cheque will take a few days to clear and then the situation will be fine but no that’s not how it works. You will have to face consequences for doing such activities. So always remember and never write and try to cash out cheques for amounts that you do not have in your bank account. This might be one of the reasons why your bank account has been frozen or blocked.

Reasons 3

Bank account is frozen or blocked because of the unpaid debt to creditors

The third reason behind a frozen or blocked bank account is having an unpaid debt to creditors. If you have any unpaid debt your creditor can get in touch with your bank and freeze your account. But in this case, the creditor can not simply take an action, the creditor will always have to go through the court and only then he or she can freeze or block your account. So in this case usually the creditor always tells you before filing a case. So this does not take place spontaneously. So if you are someone who has unpaid debt then this might be the reason why your bank account is frozen or blocked.

Reasons 4

Bank account is frozen or blocked because of the unpaid debt to the government

The last reason behind having a frozen or blocked bank account is having unpaid debts to the government. This situation is common for people who have had unpaid student loans and people who have unpaid taxes. So people who owe money to the government may find that their bank account is frozen or blocked. In such cases, it is difficult to reactivate your bank account again as your bank account will only be unblocked when you pay your debt. So once you clear all the money that you owe your account will be successfully reactivated.

How to reactive your Frozen or Blocked bank account

How to reactive your frozen or blocked bank account of the Union Bank of India?

Now you must be wondering what’s the solution to this problem and how can we reactivate our bank account. Well if your account with the union bank of India has been blocked because of suspicious, unusual, or fraudulent activity then you will have to visit your home branch as soon as possible. You will have to meet the branch manager in person and discuss the entire situation with him.

Also in some cases, you will have to give an application too. Further, the bank will tell you to do some process, and once you follow everything that they ask for your account will be reactivated. But on the other hand, if your bank account has been blocked or frozen because of unpaid debt then your bank account will get unblocked only when you pay your debts. Once the unpaid amount is all clear your account will be reactivated. In this case, you will personally have to get in touch with your branch manager and you will have to visit your home branch too. But once the debt is paid your account will immediately get reactivated.

So we have now covered everything about having a frozen or blocked bank account. Do not panic if your account has been blocked or frozen. Just look into why your account has been frozen, find the reason, get in touch with your branch manager as soon as possible, and complete the formalities. We hope that you found this article helpful and if you did do not forget to share this article with your friends and family so that even they can benefit from it!