How to Activate & Submit Union Bank Cheque Details for Positive Pay?

Positive Pay is a security layer that is used to detect cheque fraud. This service is used by all banks and financial institutions to examine fraud. The Positive Pay checks the cheques and verifies if there are any frauds. Today we will be covering how you can activate and submit cheque details for the Union bank of India. But you have to note that you can avail of this positive pay facility only for cheque amounts of rupees 50,000 and above. Also, the positive pay service is compulsory for cheques that are of higher amounts that are higher than 50,000 rupees.

So you can activate the positive pay facility for the Union Bank of India by using one of any four methods. The first method through which you can activate positive pay is via Internet banking. The second is via visiting your nearest branch in person. The third method is by using the official mobile banking app of the Union Bank of India which is the Vyom app. And the last way through which you can activate your positive pay is through SMS banking. So in this article, we will be discussing these methods in detail. So if you want to activate positive pay then make sure that you read this article till the very end and then choose the mode of activation that suits you and is the most convenient for you.

How to Activate Union Bank Positive Pay System via Internet Banking?

The first menthol to activate positive pay is through Union Bank Internet Banking, Then we see how to enter and submit cheque details in the Union bank via Internet Banking

You have to note that is compulsory to submit the cheque details for positive pay whenever you issue cheques. But first, you will have to register your consent for positive pay. Registration is a one-time process that can be done easily in a few minutes.

Here are the steps to activate and submit cheque details for positive pay using internet banking

Step 1: Go to the official website of the Union Bank Of India. Log in to your account by entering your credentials.

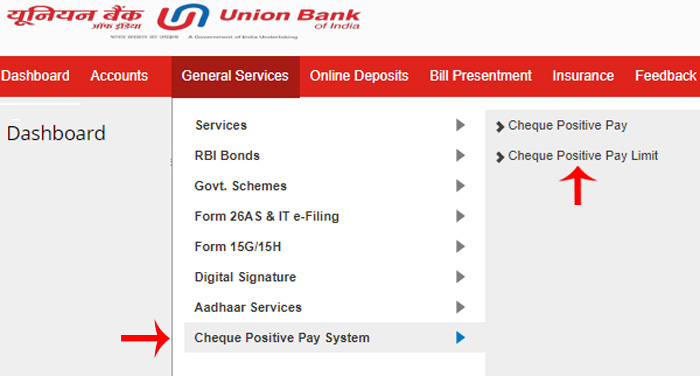

Step 2: Click on the ‘General Services’ menu option, Then click the sub-menu option ‘Cheque Positive Pay System’ then click Cheque Positive Pay Limit

Step 3: Then you will have to complete the authentication process where you will have to select your Account Number and change the Amount Limit.

How to Submit cheque details via Union Bank Internet Banking?

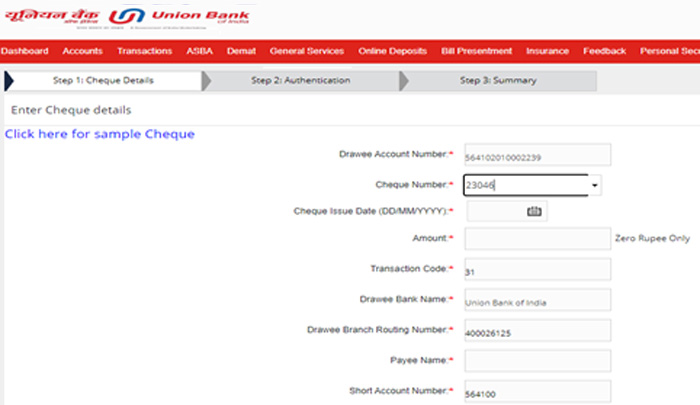

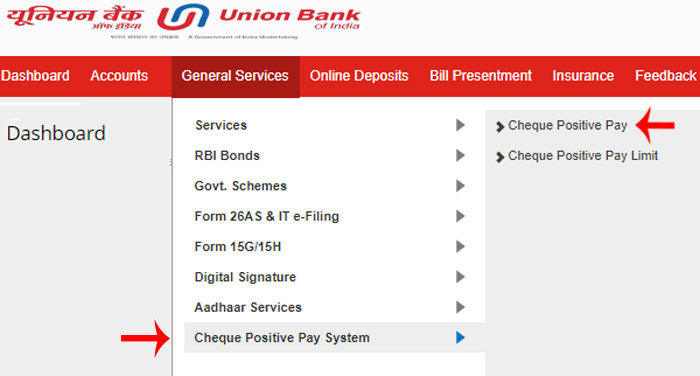

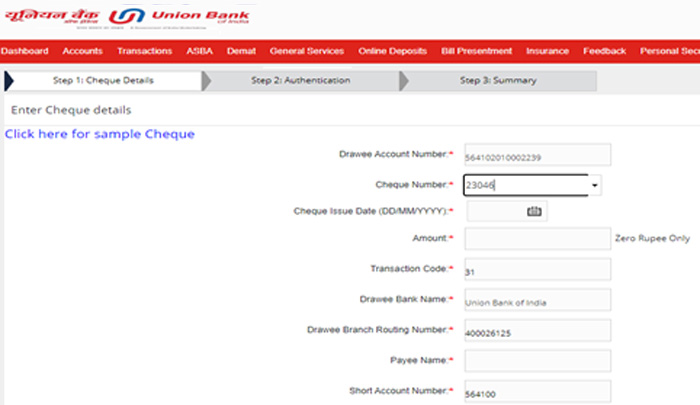

Step 1: Go to the “General Services>Cheque Positive Pay System>Cheque Positive Pay” menu option.

Step 2: Next you will have to select Account Number & Cheque Number from the drop-down list. Then enter the Cheque amount, Payee name, and Cheque date. (The amount limit should be 50,000 and above)

In the next options, you will see that your SAN number, MICR, and transaction code will be auto-updated on the screen. Just verify the details are automatically populated.

Then click on the ‘Continue’ button.

Step 3: Now an OTP will be sent to your registered mobile number for authentication purposes. Enter that OTP and then click on the ‘Submit’ button.

And voila! You have successfully registered for positive pay through internet banking.

So this is how you can activate positive pay using internet banking. Make sure that you follow all the steps given above and you will be able to activate positive pay using internet banking without any obstacles.

How to activate Union Bank Positive Pay System via Vyom App?

The second method to activate positive pay and enter cheque details through the official mobile banking app of the Union bank of India is the Vyom app

You can easily activate the positive pay service through your phone by using the Union bank of India’s mobile banking app that is the Vyom app. So if you want to activate the positive pay service through the Vyom app then follow the steps mentioned below.

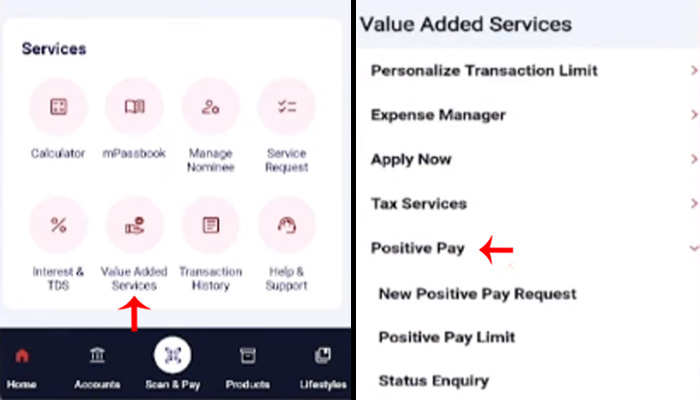

Step 1: Launch the Vyom app on your phone. Log in to your account by entering your login pin.

Step 2: You will be then redirected to the dashboard. Then go to the Service section and click on the ‘Value Added services’ option.

Step 3: Then click on the ‘Positive Pay’ option.

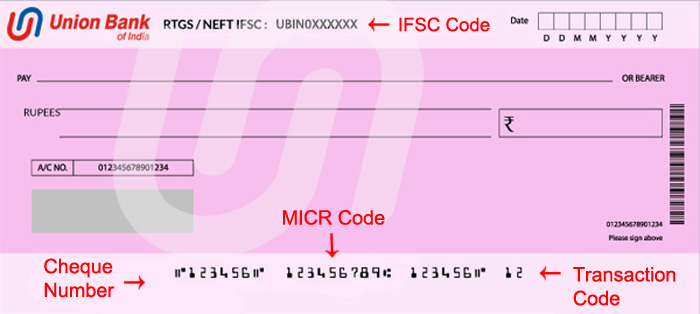

Now you will have to enter your details like your account number, cheque number, and cheque date in the DD/MM/YYYY format. Then you will have to enter your amount in rupees and you will have the option to enter paise only in 2 decimals.

Then enter the MICR code, SAN code, transaction code, and the payee name. Once you enter these details you will receive an OTP on your registered mobile number. Enter that OTP and then click on the Submit button.

And you have successfully registered for the positive pay using the Vyom app.

So this is how you can activate the positive pay service using the Vyom app. Just make sure that you follow the steps given above and you will be able to activate the positive pay service within minutes!

How to activate Union bank Positive Pay by sending an SMS?

The third way to activate the positive pay service for the Union bank of India is through SMS. So if you want to activate the positive pay service using SMS follow the steps given below.

For this, you will have to submit the list of details given below in the same sequence as mentioned. You have to send these details to this mobile number – 9223008486.

Type your details in the same sequence given below.

UCPPS <Your account number> <Your respective cheque number> < The Cheque date in the DD/MM/YYYY format> <Amount in rupees (paise can be entered only upto two decimals)> <MICR code> <SAN code> <Transaction code> <and finally the payee name>.

So type a text in the above format. Do not change the sequence of the details. Enter the details in the same order as shown above and make sure that you carefully send this to the contact number mentioned above. Verify the details before sending.

How to activate Positive Pay by Visiting the Union Branch?

The customers of the Union bank of India can do the activation process of positive pay in person by visiting the nearest bank branch. Here everything will be done offline. So you will have to submit your consent for activating the positive pay offline. So here, you will have to submit your cheque details and when they issue your cheque to the beneficiary. And you need not worry as the activation of positive pay is a one-time process.

A few things to Note

- Modifications or changes cannot be made once the details are sent to the National Payments Corporation of India which is NPCI. So make sure that you carefully enter all of your details correctly. (This is applicable for all modes)

- Once the confirmation is done, this can not be deleted.

- The positive pay is only applicable to cheques that amount to rupees 50,000 and above.

- Cheques that have the status of unused or confirmed or passed will be passed.

- The users have to submit positive pay confirmation only through any one mode for the particular cheque.

- Cheques that are three months old or more than that according to the date of confirmation will not be accepted. So make sure that your cheque is not stale. Also, remember that future dates of the cheques will be fully valid and will be accepted.

So now we have covered everything about positive pay for the Union bank of India. To avail, of this facility through any mode make sure that you follow the steps given below and you will be able to avail of this facility within a few minutes. Also, go through the points that have been mentioned above and take care of these things for a better banking experience!