ICICI Bank iMobile: Send Money across the world | Best Way To Send Money From India to Overseas

ICICI bank has come up with the most brilliant service of all time and that is the ‘Money2world’ service. This is a service that enables Indians to transfer money overseas from any bank to any bank. The best part is that this Money2world service is available not just for the ICICI customers but also to the non ICICI bank customers. This can be done by using the official mobile app of ICICI a bank that is the iMobile Pay app. So now we all can transfer money from any Bank in India to any bank across the globe. 16 major currencies are available in the Money2world service. Also, the ICICI bank enables people to transfer funds at any time as the Money2world service is available 24*7 throughout the day.

So you do not have to worry about the bank timings as you can transfer money overseas easily at any time. This comes in handy in case of emergencies. Also, this service is super easy and convenient and not at all time-consuming to use. Also, you do not have to worry about fraud as the Money2world service is absolutely secure.

So in this article, we will be discussing how you can transfer money overseas from India through the ICICI bank’s Money2world service. So make sure that you read this article till the very end to understand everything about this service in detail so that you will be able to transfer funds overseas from India easily without having to face any obstacles. Follow the steps given below to transfer money overseas using the Money2world service through the official app of ICICI bank which is the iMobile app.

Money2World: Send Money Online from India to Overseas

Here is the detailed step-by-step process to transfer money from India to overseas using the Money2world service offered by ICICI bank via the iMobile pay app –

Step 1: Lunch the iMobile Pay app on your phone. Log into your account by entering your credentials which is your four-digit login PIN code.

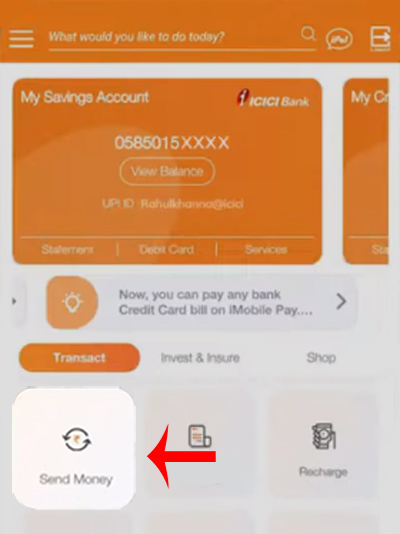

Step 2: Now you will be automatically redirected to the home page. Click on the ‘Send Money’ option.

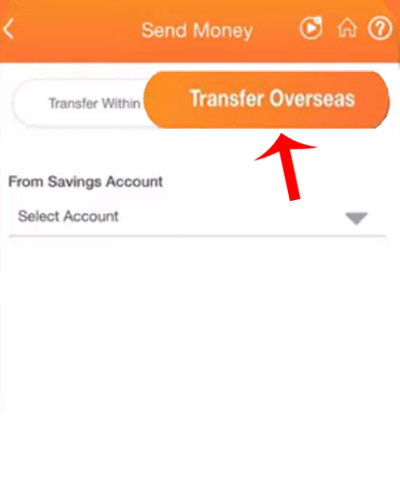

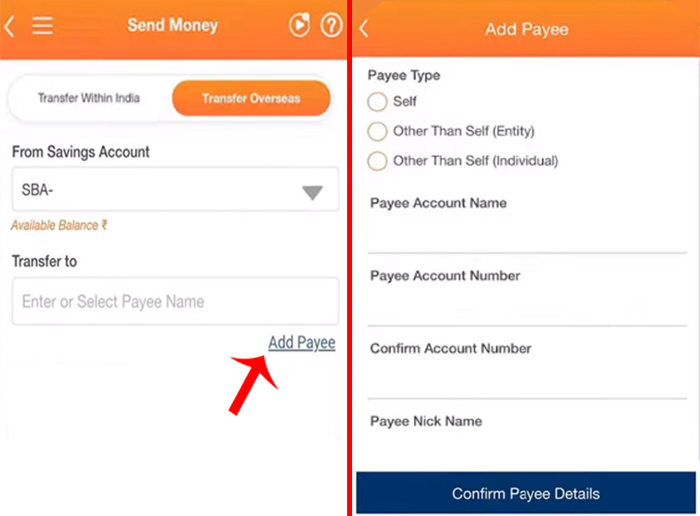

Step 3: Now you will have to click on the ‘Transfer Overseas’ option. Then you will have to select your savings account.

Step 4: Now you will have to add a payee so for that click on the ‘Add new payee’ option. Then enter the Payee details. The details which you will have to fill in are

- Payee’s account name.

- Payee’s account number.

- You will have to enter the Payee’s account number twice for confirmation purposes.

- Add a nickname for your Payee if you want.

- Payee address and zip or postal code.

- Payee’s country, mobile number, and email address.

Once you are done entering all the payee details then click on the ‘Confirm payee details’ button.

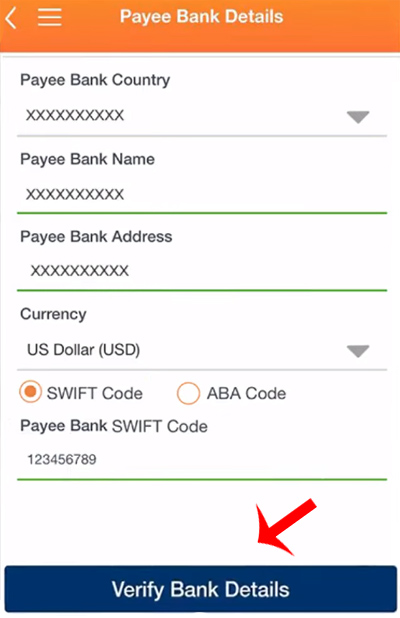

Step 5: Now you will have to enter your payee’s bank account details which include the payee’s country, the name of your payee’s bank, bank address, and payee’s currency.

Now you get two options. You can either enter your payee’s swift code or ABA code.

Check all the details that you have entered and then click on the ‘Verify bank details’ options.

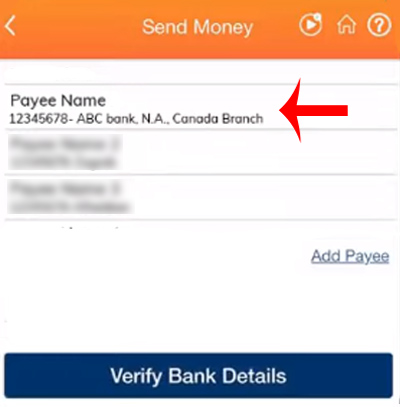

Step 6: Now an OTP will be sent to your registered mobile number. Enter the six-digit OTP that you have received. And then your payee will be added successfully.

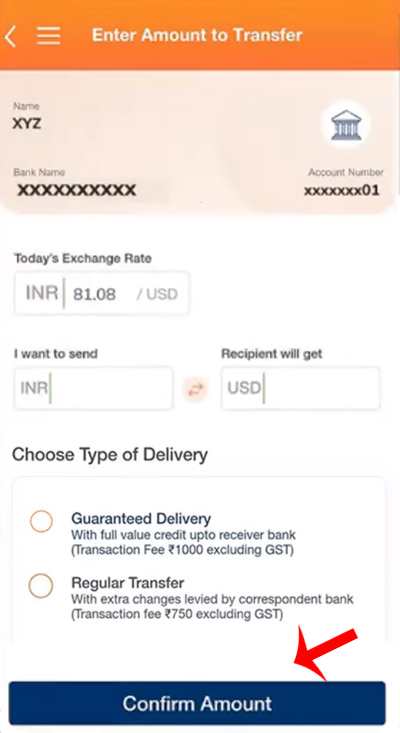

Step 7: Now you will have to enter the transaction amount. You can either enter it in rupees or in foreign currency as well.

Now further you will have to choose a delivery type. There are two options available from which you can select any one whichever is the most convenient for you. The first delivery type is ‘Guaranteed Delivery’ and the second delivery type is ‘Regular delivery’.

- Guaranteed delivery type can be received in the United States of America only. This delivery type is not valid for other countries. Also, the guaranteed delivery type enables full-value credits for transfers to beneficiary’s accounts and no extra charges will be levied by any intermediary or correspondent banks. The charges for Guaranteed delivery type can be around rupees 1000 to 2000 + GST.

- The Regular delivery type is received by all countries and you have to note extra charges will be levied by the correspondent or intermediary banks on the credit to beneficiary accounts. The charge for the Regular delivery type can be around rupees 750 + GST.

Note: The charges may vary. If you want to know more about the charges then visit the official website of ICICI bank.

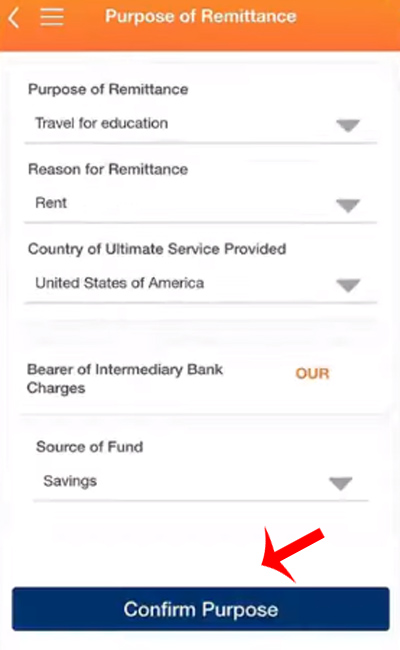

Here in this article, we will be selecting the Guaranteed delivery type. Now you will have to select your purpose of remittance and the source of funds.

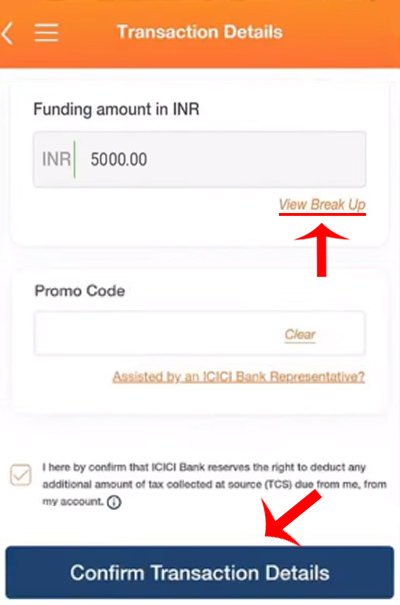

Now before you proceed you will have to click on the ‘View Break Up’ option. Select the check-boxes and accept the declaration, terms, and conditions.

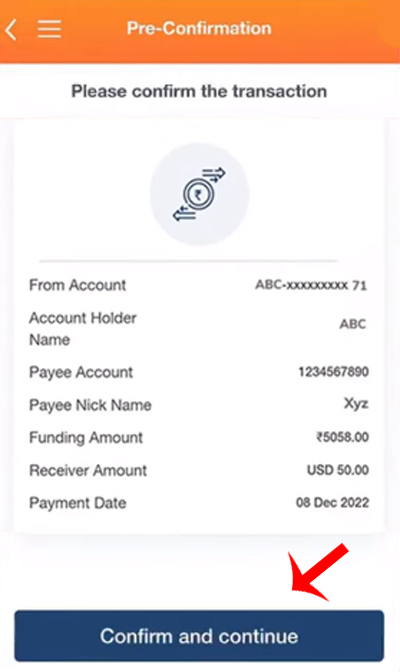

Now check your transaction details carefully. Once you are done reviewing your transaction details and if they are all correct then proceed by clicking on the ‘Confirm and Continue’ button.

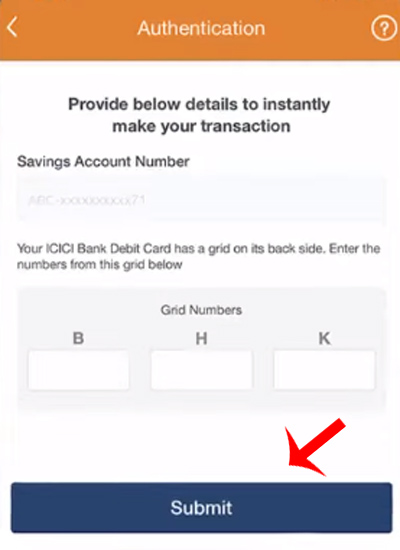

Step 8: Now for authentication purposes, you will receive an OTP on your registered mobile number. Enter that OTP. And then you will have to enter your debit card grid values.

And voila your transaction has been initiated! You have successfully initiated the transfer of money overseas using the Money2world service through the iMobile app.

Once the transaction is submitted and completed the respective funds will be debited from your selected account. And then your transaction will be processed within one international working day. So this is how you can easily and conveniently send funds using the Money2world service offered by the ICICI bank via its iMobile app. You have to remember that according to international working day transactions are usually received before 15:00 pm on the weekends. Also, remember that it is usually processed within one working international day but this may take a longer time if intermediary banks are involved in the transaction. This varies for every transaction as it depends totally on the country, the type of delivery that you have selected, and also depends on how you have paid for the transaction.

But the good part is when you transfer funds using the Money2world service overseas you can check the status of your money transfer. In order to check the status of your transaction you just have to log in to the official website of ICICI Money2world website and then go to the ‘Check Status’ option. Here you will be able to see the status of your transaction and whether it is completed or not.

The 16 currencies available through this service are as follows-

- The United States Dollars USD

- Euros

- The British Sterling Pound GBP

- Singapore dollars SGD

- The Canadian Dollars CAD

- The Australian dollars AUD

- The Swiss Franc CHF

- The Hong Kong dollars HKD

- The Japanese Yen JPY

- The Arab Emirates Dhiram AED

- The Saudi Arabian Riyal SAR

- The Danish Kroner DKK

- The Norwegian Kroner NOk

- The Swedish Kroner SEK

- The Quatari Riyal QAR

- The New Zealand Dollar NZD

These are the 16 currencies available on the Money2world service offered by the ICICI bank. So this is how you can transfer funds from India to abroad using the Money2world service offered by ICICI a bank. We have covered all the things about this service. So just make sure that you read this article carefully and also make sure that you follow all the steps given above. So make sure that you take advantage of the Money2world service and this is how you can conveniently and easily transfer funds using the Money2world service offered by the ICICI bank via the iMobile app!