How to Pay Kotak Credit Card Bill Online

Kotak Mahindra Bank enables its customers to pay their credit card bills online. So if you are someone who has a Kotak credit card this article is for you.

In this article, we will be discussing how you can easily pay your Kotak credit card bill online. The different payment methods for Kotak credit card users are net banking, mobile banking, Bill desk, NEFT / IMPS, Auto debit, VISA bill payment, phone banking, cheque, cash, RTGS, and UPI. You can choose any payment method of your choice and according to your convenience pay your credit card bill.

We will be breaking down the entire process into easy steps. So make sure that you read this article till the very end and do not forget to follow the step-by-step process given below.

Here is the step-by-step process to pay your Kotak credit card bill online

How to Pay Kotak Credit Card Bill Online

Step 1: Open any browser on your mobile phone, laptop, or computer. Then go to the official website of Kotak Mahindra Bank.

Kotak Bank Official Website – www.kotak.com

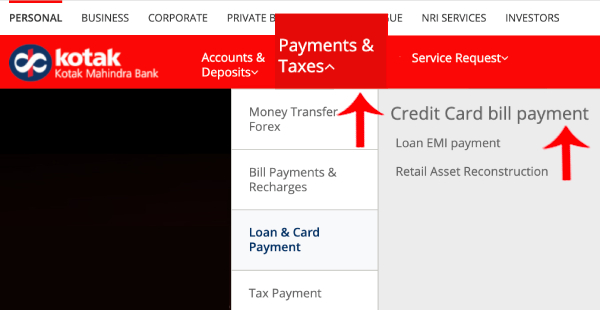

Step 2: Here you will have to click on the ‘Payment & Taxes’ option. A drop-down menu will appear from which you will have to choose the ‘Loan & Card Payment’ option. Now under the card option, you will have to click on the ‘Credit Card bill payment’ option.

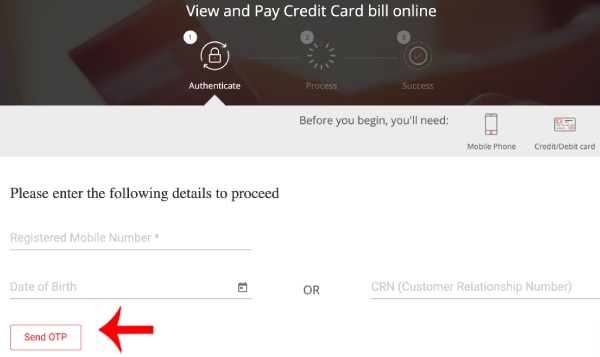

Step 3: Now you will have to enter your details which are your registered mobile number, either your date of birth or your CRN number. Once you enter these details correctly click on the ‘Send OTP’ option.

You will now receive an OTP on your registered mobile number. Enter the OTP that you have received and then click on the ‘Confirm’ button.

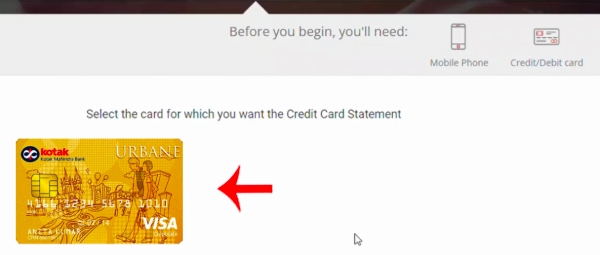

Step 4: Once you click on the confirm button you will be able to see your virtual credit card on the screen. Click on the credit card that appears on the screen.

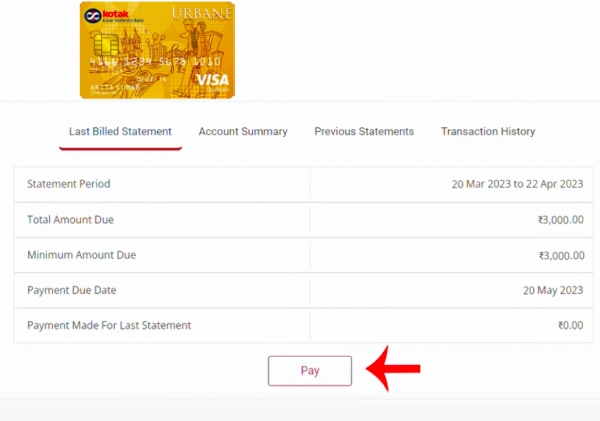

Step 5: Once you click on it your credit card details will be opened. Here you will be able to see your credit cards details like your Latest billing statement, Account summary, previous statements, and transaction history. Here you will be able to see your minimum due amount so you will get to know how much amount you have to pay. So go through your details once and then click on the ‘Pay’ button.

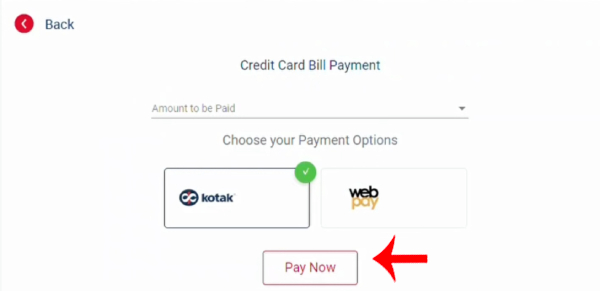

Step 6: Here you will have to select how much you want to pay that is you can either pay your minimum due amount or your total due amount. Select the option that you want and if you will be paying through Kotak then you will have to click on the ‘Kotak’ option. If you will be paying through some other bank then you will have to select the ‘Web pay’ option.

Once you are done selecting these two things then click on the ‘Pay now’ button.

Step 7: A disclaimer will pop up on your screen, just click on the ‘I agree’ option. Now you will have to enter your 16-digit Kotak credit card number.

(You will have to enter your credit card number twice for confirmation purposes) Then enter your registered mobile number, registered email ID, and your payment amount, and select the bank through which you will be making the payment.

Once you are done entering these details click on the ‘Pay now’ option.

Step 13: Now the payment window will be opened and you can successfully make your payment.

So this is how you can easily pay your Kotak credit card bill online in just a few minutes. Always remember that missing your bill payment or even paying your bill late can badly affect your credit score. So make sure that you pay your credit card bills on time. Also, the steps remain the exact same for other billing methods too. We have now covered the detailed step-by-step process to pay your credit card bills.

So follow all the steps mentioned above to avoid any obstacles or mistakes. We hope that this article helped you and if it did then do not forget to share it with your friends and family so that even they can benefit from it and have a happy banking experience!