Check Free CIBIL Score & Report on Paytm App

We all know that the credit score is the most important thing. It plays a major part in the loan sanction, etc. Credit score determines your credit worthiness hence it becomes one of the most important things. But how do you check your credit score? You must also be wondering if you can check your credit score for free or not. And the answer is Yes! You definitely can check your credit score for free. This is possible with the help of the Paytm app. So if you want to check your credit score for free this article is for you as we will be discussing the entire step-by-step process for checking your credit score with the help of the Paytm app. So make sure that you read this article carefully till the very end and do not forget to follow the process given below.

Here is the process to check your CIBIL score for free with the help of the Paytm app –

How to Check CIBIL Score Free on Paytm

Step 1: Launch the Paytm app on your phone.

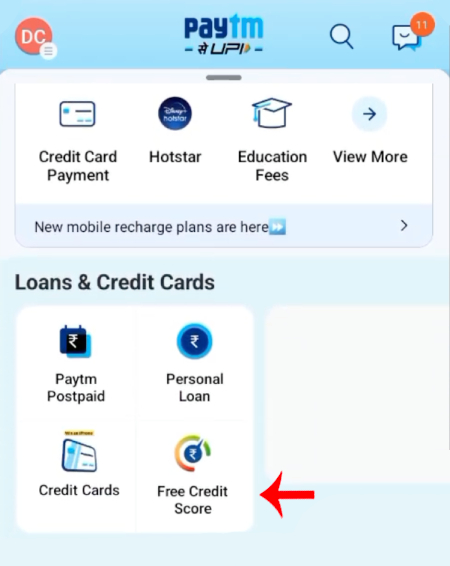

Step 2: You will then have to scroll down and then under the ‘Loan and Credit card’ section click on the ‘Free credit score’ option.

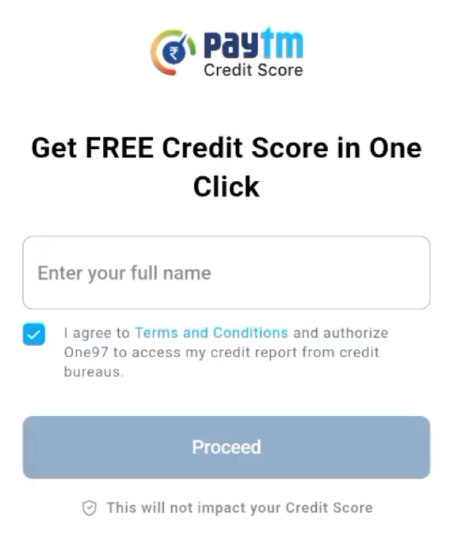

Step 3: Now you will have to enter your full name and then click on the check box and accept the terms and conditions. Then click on the ‘Proceed’ button.

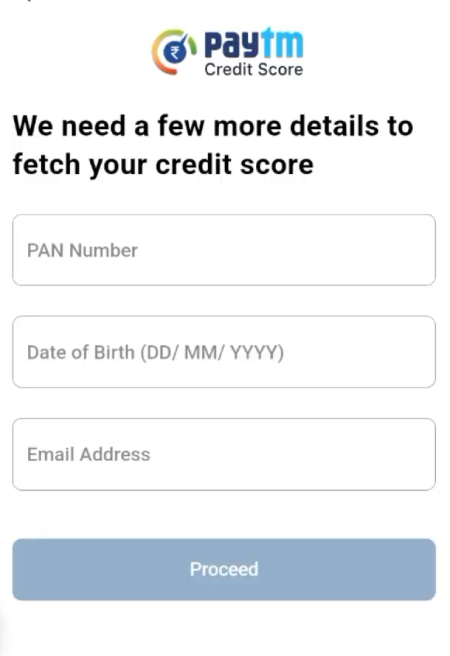

Step 4: Now you will be asked to enter your personal details like your Pan card number, date of birth in the dd/mm/yyyy format, and your email address. Once you are done entering the details click on the ‘Proceed’ button.

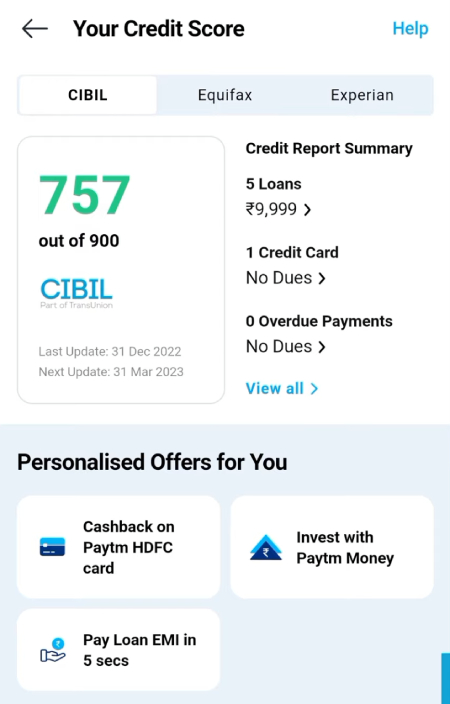

Step 5: Once you enter all the details correctly you will be able to see your credit score!

How to Read & Analyze Paytm CIBIL Report

Let’s dive deep and take a look at these factors one by one:

- Credit Report Summary: The credit report summary is a brief overview of your creditworthiness. It includes information about your credit accounts, such as the types of credit you have, your outstanding balances, your payment history, and any outstanding debt. The summary is used by lenders and financial institutions to determine your creditworthiness.

- Overdue Payments: Overdue payments refer to any payments that have not been made by their due date. This can include missed payments, late payments, or payments that are less than the minimum amount due. Overdue payments can negatively impact your credit score and make it difficult to obtain credit in the future.

- Age of Account: The age of account refers to the length of time you have had credit accounts open. A longer credit history can be viewed as a positive factor in your creditworthiness, as it demonstrates your ability to manage credit responsibly over time.

How to Read a Credit Report

Understanding how to read a credit report is important for maintaining good credit health. A credit report is a detailed summary of an individual’s credit history, including credit accounts, payment history, loan history, and outstanding payment.

In addition to the information provided in a credit report, credit scores are also used by lenders and financial institutions to determine an individual’s creditworthiness. Credit scores typically range from 300 to 900, with a higher score indicating better creditworthiness.

- Excellent credit score: 800-900 – This indicates that the individual has an outstanding credit history and is likely to be approved for loans or credit cards with the most favorable terms and interest rates.

- Very good credit score: 740-799 – This suggests that the individual has a strong credit history and is likely to be approved for loans or credit cards with favorable terms and interest rates.

- Good credit score: 670-739 – This indicates that the individual has a solid credit history and is likely to be approved for credit, but may not receive the most favorable terms and interest rates.

- Fair credit score: 580-669 – This suggests that the individual may have some negative marks on their credit history, and may have difficulty getting approved for credit or loans with good terms and interest rates.

- Poor credit score: Below 580 – This indicates that the individual has a poor credit history and is likely to have difficulty getting approved for credit or loans, and may only be offered unfavorable terms and high interest rates.

So this is how you can check your CIBIL score for free with the help of the Paytm app. Here you will also be able to see your loans and dues, overdue payments, and the age of your accounts as well. So from now on you do not have to get any subscriptions, you simply can check your credit score without having to pay any extra charges that are for free with the help of the Paytm app. Do not forget to follow the detailed step-by-step process mentioned above and you will be able to check your credit score just within a few minutes!