How to Generate/Change Union Bank ATM Pin through Vyom App?

The Union bank of India’s official mobile banking app that is the Union Vyom app enables you to reset or change your ATM pin in minutes. An ATM PIN is a four-digit code that is unique to an account holder’s ATM card. It is required to complete transactions, thus ensuring security and avoiding fraudulent activities. So if you have an ATM card from the Union bank of India and if you have forgotten your ATM pin or you are caught up in a situation and you want to change your ATM pin then this article is for you.

In this article, we will be discussing the step-by-step process for changing or resetting your ATM pin through the Union Vyom mobile banking app. So make sure that you stick around till the end and read the complete article carefully. All you have to do is follow the steps given below and you will be able to change the pin of your Union bank of India ATM card by sitting at home using the Union Vyom app that too without having to face any trouble.

How to Generate/Change Union Bank ATM Pin through Vyom app in 1 Minute

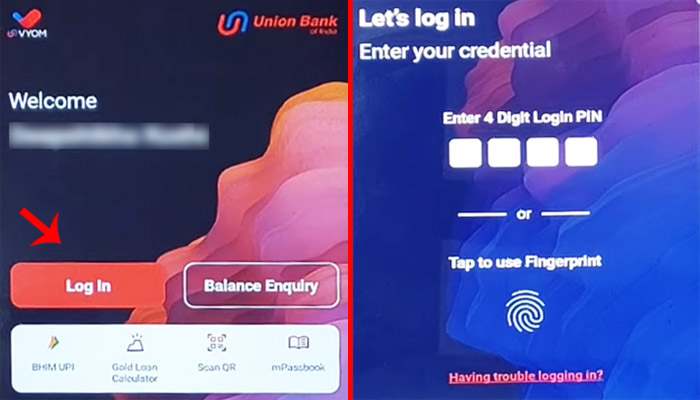

Step 1: Launch the Union Vyom app on your phone. Enter your login pin and log in to your account.

Read More: How to reset Union Vyom app Login Pin ?

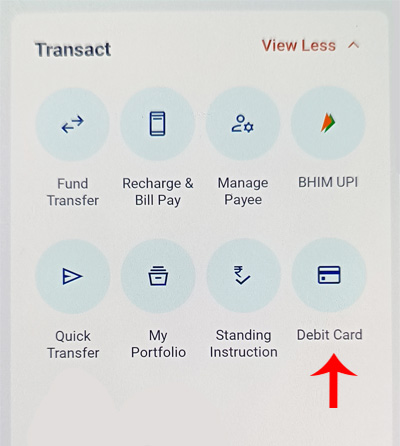

Step 2: Once you log in to your account you will be automatically redirected to the dashboard. Then scroll down and select the ‘View more’ option under the Transact menu.

A drop-down menu will appear. From that click on the ‘Debit Card’ option.

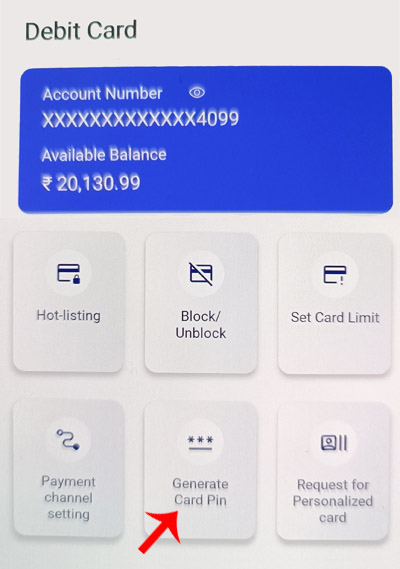

Step 3: Now scroll down and click on the ‘Generate the card pin’ option.

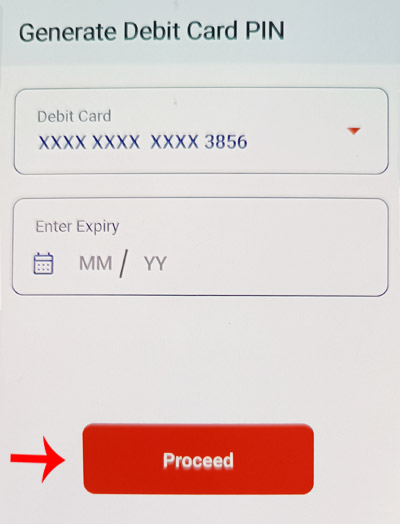

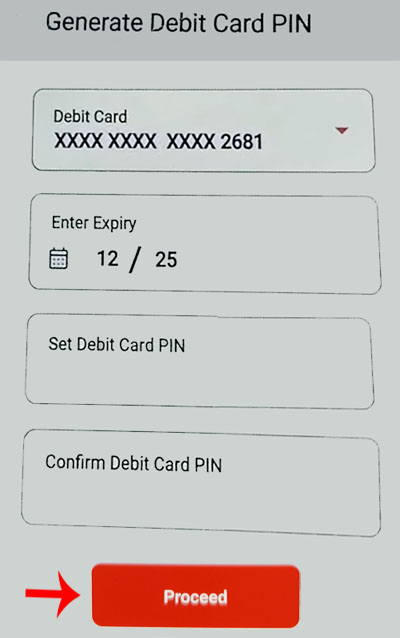

Step 4: Now you will have to select the debit card for which you want to generate the debit card pin.

Now you will have to enter your debit card details like the debit card number and your debit card’s expiry date in the MM/YY format. And then click on the ‘Proceed’ button.

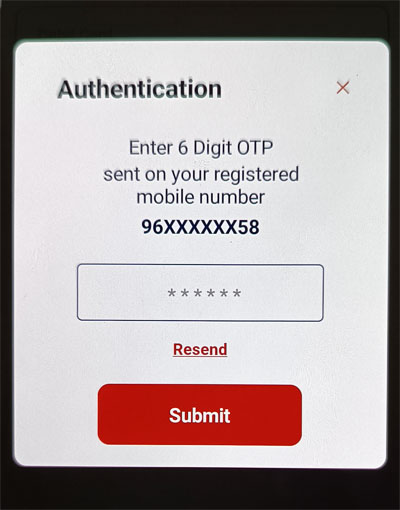

Step 5: Now you will receive a six-digit OPT on your registered mobile number. Enter that OTP and click on the ‘Submit’ button.

Step 6: Once your OTP is verified you will see an option to set your debit card pin. So now you have to create and enter the four-digit pin that you want to set.

You will have to re-enter the same pin that you have entered above for confirmation purposes. And then click on the ‘Proceed’ button.

And you have successfully generated the ATM pin for your Union bank of India ATM card using the Union Vyom mobile banking app.

Now, remember that this process remains the same even in cases where you have a new debit card and you want to generate the ATM pin for it. Also, this process is valid in situations where you have forgotten your ATM or you remember it but still are willing to change it. When you set the ATM pin remember that the PIN code should always be super strong. It is advisable to avoid using birth dates, birth years, and also the number combinations like 1111, 0000, and 1234.

Make sure that your ATM pin is not very predictable but at the same time, it should also be easy to remember. And it is also advisable to keep changing your ATM pin from time to time. You have to take care of the above-mentioned things to stay away and as a preventive measure from fraudulent activities.

Remember that you should never share your ATM pin with anyone. Also, do not conduct any transactions with suspicious websites. You also have to be super cautious and careful while entering your ATM PIN in public places. So follow the above step-by-step process carefully to generate the ATM pin for your Union bank of India’s debit card using the Union Vyom mobile banking app without any obstacles. And make sure that you take care of the above-mentioned things to avoid fraudulent activities and if you notice any unusual activity then report it to the bank as soon as possible. We hope that you have a safe and secure banking experience.