Check your TDS/TCS credit & High value Transactions using AIS App

You can easily check if the TDS or TCS has been credited to your account or not with the help of the AIS for taxpayers mobile app. There is nothing to worry about as this app is officially launched by the income tax department so it is absolutely secure. With the help of the AIS for Taxpayers, you can check if the TDS or TCS has been credited to your account or not, you can also check if you have carried out any high-value transactions such as your cash withdrawals, buying a house or car, security.

You can also check how much-advanced tax and self-assessment tax that is the SAT you have paid, not just this but you can also check if the income tax department has sent you any demand or refund of tax including interest on such refunds and many more. This app is available on both android and iOS devices. So now let us dive deep and understand the detailed step-by-step process as to how you can check if the TDS or TCS has been credited to your respective account or not with the help of the AIS for taxpayers app. Make sure that you follow the process mentioned below to avoid any obstacles.

How do I sign up for AIS App for the first time?

Here is the detailed step-by-step process as to how you can sign into the AIS for taxpayers app –

Step 1: Download the AIS for taxpayers app on your mobile phone. (For Android users, go to the play store, and for iOS users download the app from the AppStore)

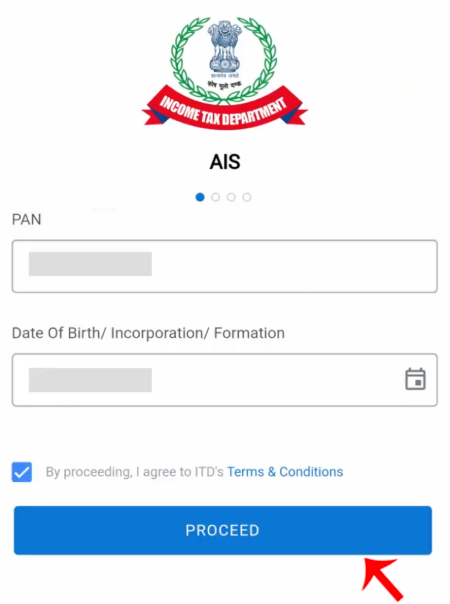

Step 2: Once you open the app you will be redirected to the first interface. Here, you will have to enter your PAN Card number and date of birth. Then click on the check box and accept the terms and conditions and then click on the ‘Proceed’ button.

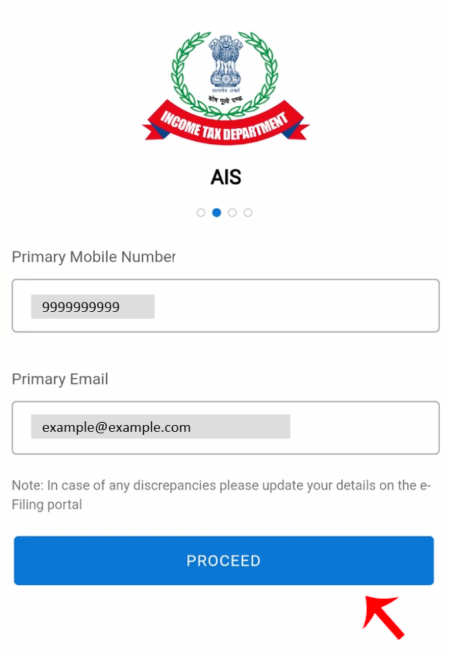

Step 3: Now you will have to enter your primary mobile number and your primary email ID as well and then click on the proceed button. (Remember that you only have to enter the mobile number and the email ID that is registered in the income tax database)

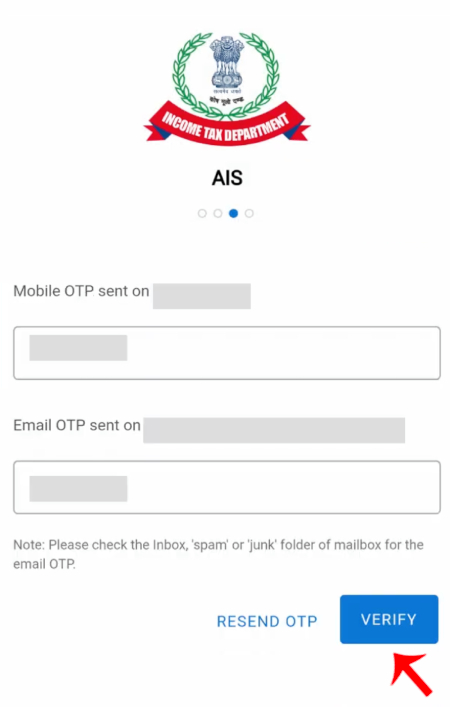

Step 4: You will then receive an OTP on your registered mobile number and your email address as well. Enter both the OTPs that you just received and then click on the ‘Verify’ button. (You will receive two different OTPs on your mobile number and email ID so enter those correctly)

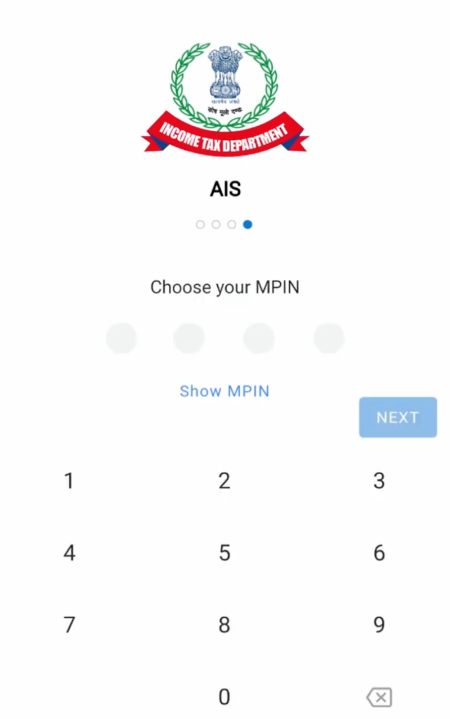

Step 5: Now you will have to set a four-digit MPIN. Create your MPIN and then click on the ‘Next’ button.

Step 6: Now enter the same previously set MPIN and then click on the ‘Confirm’ button. And voila! You have successfully completed the Sign In process on the AIS for taxpayers mobile app.

Now that you have signed in to the AIS for taxpayers app successfully, you will now have to log in to your account to further check if the TDS or TCS has been credited to your account or not. Let us now see the process after signing in to your AIS for taxpayers account.

Check TDS/TCS Credit & High-Value Transactions with AIS App

Here is the detailed step-by-step process through which you can check if the TDS or TCS has been credited to your account or not –

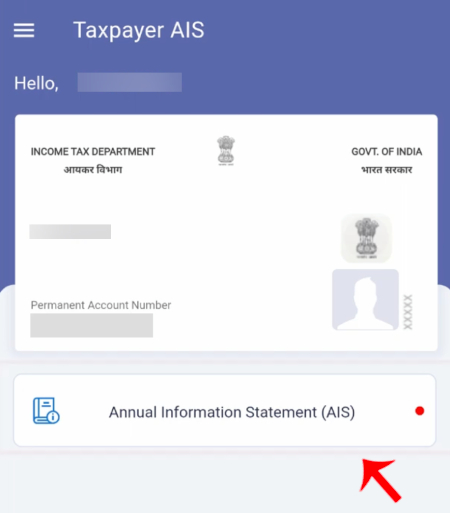

Step 1: Open the AIS for taxpayers app on your mobile phone. Log in to your account by entering your four-digit MPIN.

Step 2: Once you log in successfully you will be then redirected to the home page. Click on the ‘Annual Information Statement’ that is the AIS.

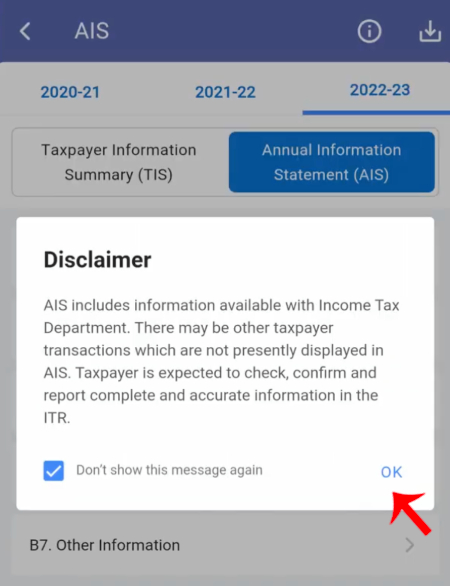

Step 3: Read the disclaimer carefully and then accept the terms and conditions by simply clicking the Ok button.

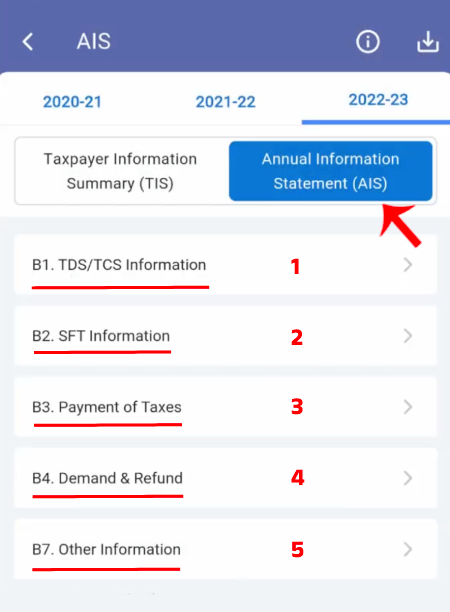

Step 4: You will then see your AIS for the current financial year which is 2022-2023.

You will be able to see the below-mentioned five parameters. The five parameters are as follows

- TDS or TCS information – Under the TDS or TCS information here you will get the information on all the transactions on which TDS or TCS is either deducted or collected.

- SFT information – Under the SFT information you will get to check if you have carried out any high-value transactions, for example, cash withdrawals, or purchase of immovable or even movable properties for example a house, car, securities, etc.

You can also see if any transaction has to be reported by any entities as a part of the statement of financial transactions that is the SFT. So all such transactions will be available under the SFT information.

- Payment of taxes – Under the payment of taxes you will be able to see how much advance tax or self-assessment tax you have paid.

- Demand and Refund – Under the demand and refund you will be able to check if any demand or notice has been sent to you or if there is any refund of tax that is due.

- Other information – Under the other information you will be able to see the details for example the breakdown of your salary, interest on refund of your income tax, and much more.

Step 5: Click on the first option which is the ‘TIS information’.

Once you click on it, you will be able to see all the transactions on which TDS or TCS has been deducted or credited to your account.

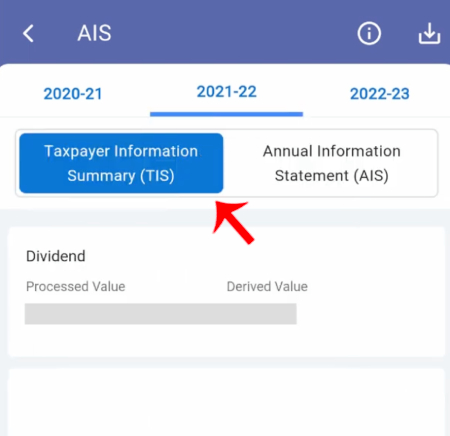

So this is how you can easily check if TDS or TCS has been credited to your account or not. Using the AIS for taxpayers app you can also check the TIS which is the ‘Taxpayer Information Summary’. The Taxpayer Information Summary is the data that is available in your AIS. The data from the TIS is used to prefill your income tax return. So under the TIS option, you will be able to check the summary of all the transactions. This AIS and TIS are not only available for the current financial year but also available for the past two financial years. The AIS for taxpayers app also lets you download the AIS and TIS in PDF format.

Important Points to Remember

- Whenever you carry out any transaction, the transaction does not immediately appear on the AIS.

- The transactions do not appear immediately because the person who collects or even deducts tax from you are obligated to pay this tax to the government. He/she has to file a TDS or TCS return first which is done once a quarter.

- Hence the transaction appears in your AIS only after the collector files a TDS or TCS return.

- If the collector does not file a TDS or TCS return then the transaction will not appear in your AIS.

What are TDS and TCS explain with an appropriate example?

We all know that when it comes to prescribed payments such as interest, commissions, brokerage, rent, and many more the person who makes the payment is required to deduct tax at source TDS at a certain prescribed rate. In such cases, the ‘payer’ is known as the deductor and the ‘payee’ who receives the payment is called the deductee.

TCS Example: So for example when you buy a car that let us say costs you more than 10 lakh rupees the car dealer collects the TCS tax from you. Then the dealer tells us that we will be able to get this money back from the income tax department later when we file our income tax return. Another case is whenever we sell land or plot for Rs. 50 lakhs or even more, here the buyer deducts the TDS tax and pays you the remaining amount.

TDS Example: Another example is when you receive your salary the employer deducts TDS or if you are an entrepreneur that is if you are into business or if you are a professional then your clients deduct TDS on the invoices that you generate.

These are examples to understand how and at which instances the TDS / TCS tax is deducted. When you carry out any transaction on which the TDS or TCS is applicable and if you are not aware or if you do not know if this tax is actually credited to your account or not. It becomes extremely important for you to know if the TDS or TCS has been credited to your account or not. This is super important as you will be able to get this money back from the income tax department only if it is credited to your account.

So now we have covered everything about the TDS and TCS and also how you can check if the TDS and TCS has been credited or not. So make sure that you follow all the steps given above and also make sure to take care of the important things mentioned above.