How to Get Acko Bike Insurance Online (Secure Your Ride)

Having insurance for your two-wheeler is highly beneficial, but have you considered which insurance provider is the best for your bike? Don’t worry, we have got you covered. Acko Insurance is the optimal choice for insuring your bike. The best part is that you don’t need to pay a large amount for it; you can conveniently obtain bike insurance online from the comfort of your home. The process is extremely easy and time-efficient, allowing you to secure insurance within minutes.

You must be aware that two-wheeler insurance is mandatory in India and has proven to be highly beneficial. As per the Motor Vehicle Act, of 1988, all vehicles must have a minimum of third-party insurance.

In this article, we will provide a comprehensive, step-by-step breakdown of the process to obtain an Acko insurance policy for your bike or two-wheeler. It is important to follow all the steps below and read this article until the end to avoid any mistakes or obstacles. Let’s proceed and delve into the detailed step-by-step process of acquiring an Acko insurance policy for your bike or two-wheeler.

How to Get Acko Bike Insurance Online

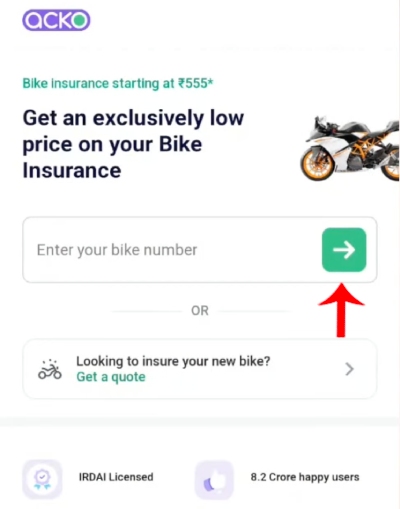

Step 1: To begin, simply click on the link acko.com. This will directly take you to the homepage of Acko.

Step 2: Now here you will have to enter the number of your bike. And then click on the green arrow icon.

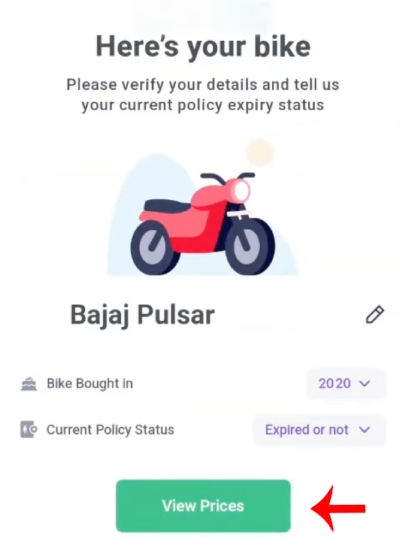

Step 3: Now the details of your bike will be opened which will include the model of your bike, the year in which you bought your bike, and your current bike policy status.

Here you will see an ‘Expired or not’ button on the side of the bike policy status option. Click on the ‘Expired or not’ button.

Now you will see three options which are –

- Policy expired

- Policy expired with in 90 days

- Policy expire more than 90 days ago

Now here click on the ‘View prices’ button.

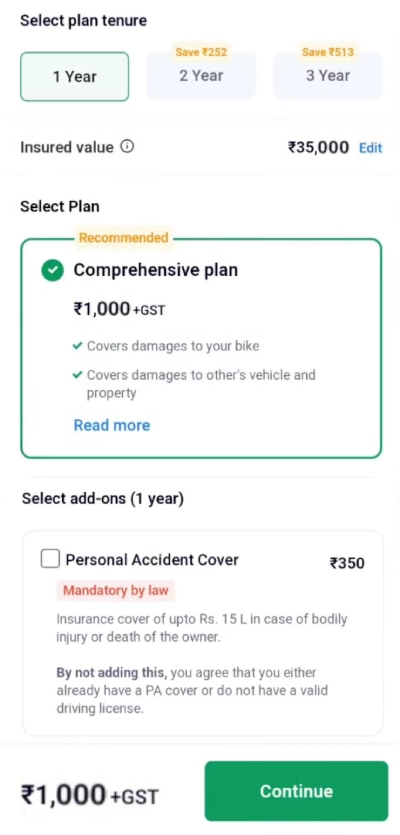

Step 4: Now you will be able to see different insurance prices for your bike. Here you can select the number of years you want to buy the insurance policy for your bike according to your convenience. For this article, we will be selecting the ‘One-year’ option.

Now when you scroll down you will be able to see two insurance policy plan options which are a Comprehensive Plan and Third Party Plan. You can select any plan according to your convenience but it is advisable to choose the Comprehensive Plan as your damages will be covered in the comprehensive plan but will not be covered in the Third Party Plan. So click on the ‘Comprehensive plan’ here.

Now if you scroll down a bit you will also see the option as ‘Personal accidental cover’. Here if you do not have personal insurance then you can get an add-on option that is ‘Personal accidental cover’. If you do not want to go for the personal accidental cover then it’s alright you can simply move on and click on the ‘Continue’ button.

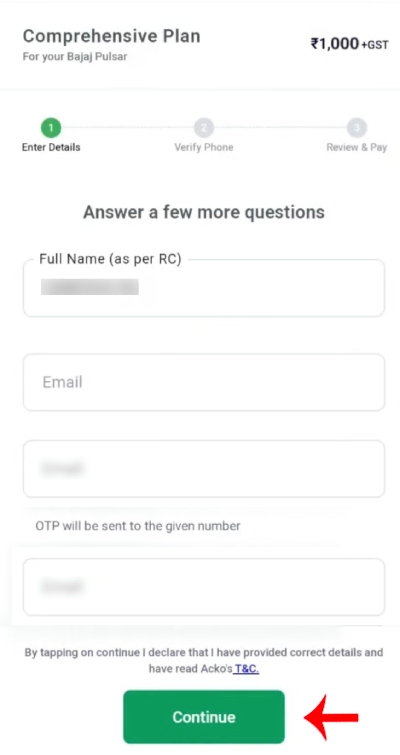

Step 5: Now an interface will be opened where your full name and bike number will be auto-filled. You will just have to enter your mobile number, email ID. Once you are done entering these details you will just have to click on the ‘Continue’ button.

Step 6: Once you click on the continue button, you will receive an OTP on the mobile number that you have previously entered. So enter that OTP that you have just received and then you will just have to click on the ‘Enter’ button.

Now click on the ‘Verify’ button. Once your OTP is verified a new interface will be opened.

Step 7: Here you will be able to see your bike details and the details of the respective bike owner as well.

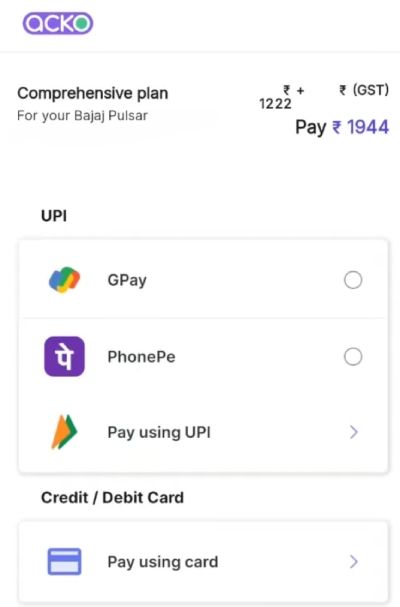

Now cross-check and see if all the details are correct and click on the ‘Pay now’ button. Now you can choose your payment method among the available options which are debit card, credit card, UPI, QR code, internet banking, etc. So choose the payment method of your choice and then you will be redirected to the payment gateway.

Now all you have to do is proceed and complete the payment and voila! You have completed the process of buying insurance for your bike.

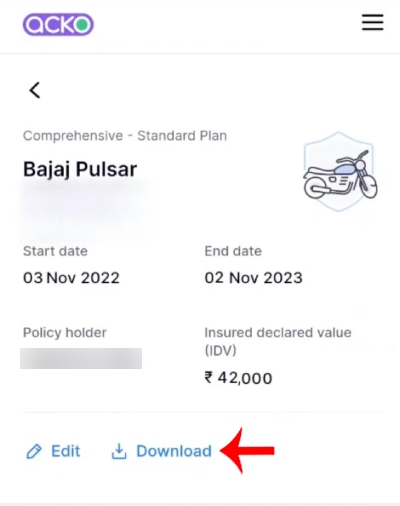

Once you are done making the payment you will see that an interface will be opened. Here you can download the policy as a pdf document and save it for the future. You can also take a printout of it. So this is how you can easily buy an insurance policy for your bike or two-wheeler.

Also, the Acko insurance policy is one of the most trusted policies available. So you can go ahead and definitely give it a try as you will not be disappointed. So whenever your bike or two-wheeler is damaged you can just download the Acko app on your mobile phone and log in to your account by entering your mobile number.

Then further you will just have to claim it and the damages will be covered under your Acko insurance policy. So we have now covered everything about how you can get an Acko insurance policy for your bike or two-wheeler. Just make sure that you follow all the steps given above. We hope that you have found this article helpful and if it was then do not forget to share this article with your friends and family so that even they can benefit from it!