How to Set Transaction Limits Using Union Vyom App (UPI, Online Transfer)

Do you want to protect yourself from fraud? Yes. We all want to. But such things are unpredictable. But what we can do to prevent ourselves and not lose money is by setting a transaction limit. When you set a particular transaction limit to your account you will not lose a huge chunk of money and you will not fall victim to fraud. Transaction limit ensures that the money withdrawn from the account will only be up to the limit set by you.

So if you have an account in the Union bank of India and if you want to set a transaction limit for your account then this article is for you. In this article, we will be breaking down the entire step-by-step process to set a transaction limit to your account in the Union bank of India through the official mobile banking app that is the Vyom app. So make sure that you follow the entire process mentioned below and read this article till the very end.

How to set Online transaction limit in Union Vyom App?

Here is the detailed step-by-step process to set a transaction limit for the Union bank of India through the Vyom app –

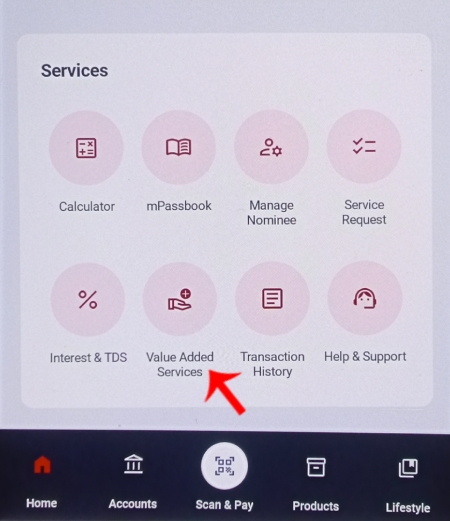

Step 1: Launch the Vyom app on your phone and enter your login PIN code and log in to your account.

Step 2: Now scroll down and then click on the ‘Value added services’ option.

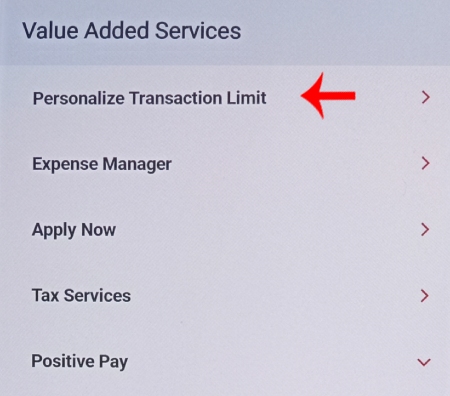

Step 3: Then you will have to click on the ‘Personalize transaction limit’ option.

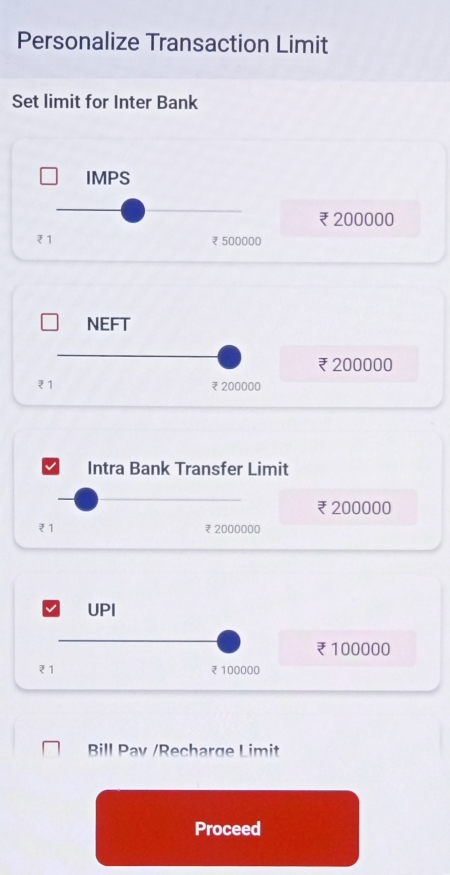

Step 4: Here you will see the option to set a transaction limit for IMPS, NEFT, Intra bank Transfer limit, UPI limit, and bill pay or recharge. Now you just have to scroll, adjust and set your transaction limit accordingly.

Once you set the limit then click on the ‘Proceed’ option.

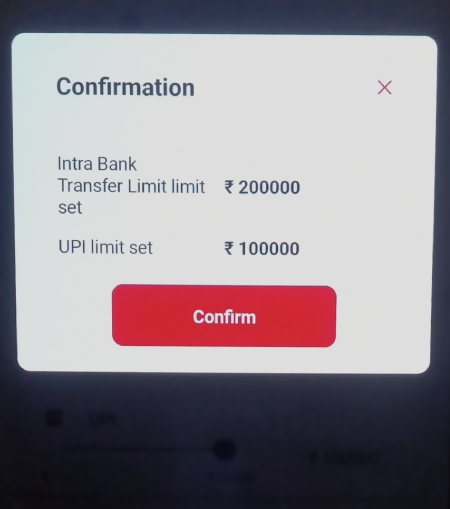

Step 5: Now a confirmation page will appear. Here verify the details and if they are correct then click on the ‘Confirm’ option.

Step 6: Now you will have to enter your four-digit transaction pin for authentication purposes.

And voila! You have successfully set a transaction limit for your account in the Union bank of India through the Vyom app.

Now you will have to remember that there is a maximum transaction limit. So you can not set your transaction limit above that respective amount.

Here are the maximum transaction limits –

- The maximum transaction limit for IMPS is Rs 5,00,000.

- The maximum transaction limit for NEFT is Rs. 2,00,000.

- The maximum transaction limit for Intra Bank transfers is Rs. 20,00,000.

- The maximum transaction limit for UPI is Rs. 1,00,000.

- The maximum transaction limit for Bill pay or Recharge is Rs. 2,00,000.

So these are the maximum transaction limits for IMPS, NEFT, Intra bank transfer, UPI, and bill pay or recharge respectively. Keep the maximum transaction limit in your mind while setting your transaction limit. When you set a lower transaction limit only the amount up to the limit can be withdrawn from your account. This comes in very handy in cases of financial fraud. So set the transaction limit according to your personal spending pattern.

So we have now covered everything about setting the transaction limit for the Union bank of India using the Vyom app. Just make sure that you follow all the steps given below correctly and you will be easily able to set a transaction limit for your account in the Union bank of India through the Vyom app without having to face any troubles just within a few minutes that too at the comfort of your home!