India Post Office Mobile Banking – Steps to Register & Activate

The Department of Posts (DOP) now enables you to access mobile banking services. Post office mobile banking can now help you out with various tasks such as transferring funds, and depositing funds into your PPF and SSY accounts, along with many other services.

Note that you will first have to submit a form in your branch for availing of Internet banking and Mobile banking services. Once you submit the form you will receive a link through which you will first have to activate your Internet banking. You can only avail of the mobile banking service for your post office savings account only if you have activated your internet banking. We already write an article about ‘How To Activate Internet Banking in Post Office‘. In this article, we will discuss the steps to activate mobile banking for your post office savings account.

The requirements for activating mobile banking services for your post office savings account are as follows-

- You must have a valid active Single or Joint “B” Savings account standing at CBS Sub Post Office or Head Post Office.

- All the accounts standing at Branch Post Office are not eligible for availing Internet banking facility of any sort.

- You should make sure that you complete the KYC process and provide all the documents that are required.

- You must have a valid unique mobile number, an email address, and PAN Card.

- You will also have to first submit an ‘ATM or Intra operable Internet banking and mobile banking request form’ to your nearest branch to avail of internet banking services.

How to Activate Post Office Mobile Banking for the First Time

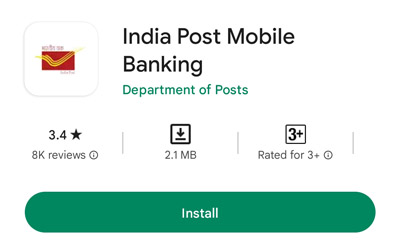

Step 1: Download the ‘Indian Post Mobile Banking’ app from your play store. Make sure that it is the latest version of the app.

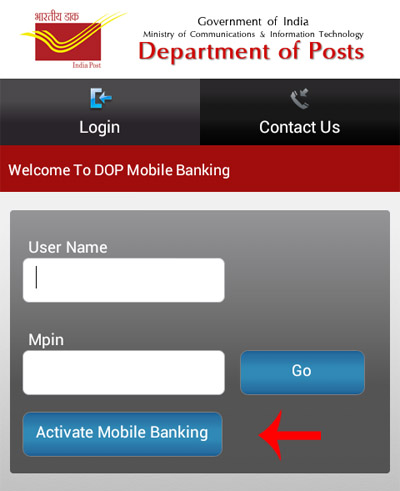

Step 2: Click on the ‘Activate mobile banking’ button.

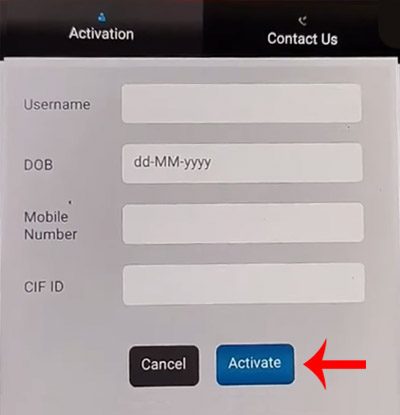

Step 3: An interface will be opened where you will have to fill in details like your username (Your CIF ID is your user name). Then enter your date of birth in the DD/MM/YYYY format and you will also have to enter your registered mobile number i.e the mobile number that is linked to your post office savings account. Re-enter your CIF ID again. And click on the ‘Activate’ button.

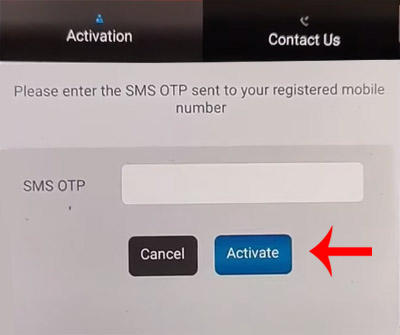

Step 4: After clicking on the activate button, you will receive a four-digit OTP on your registered mobile number. Enter that OTP and then click on the ‘Activate’ button again.

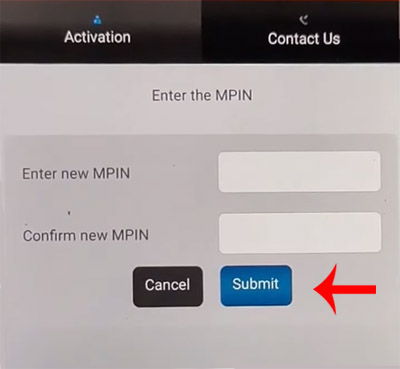

Step 5: An activation interface will be opened where you will have to set your four-digit MPIN (enter the same MPIN twice for confirmation purposes). Then click on the ‘Submit’ button.

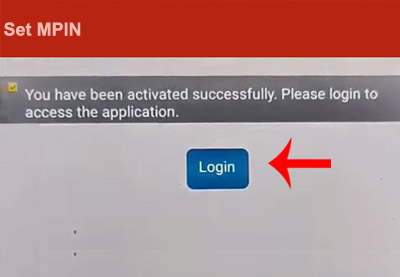

You have now successfully activated mobile banking for your post office savings account!

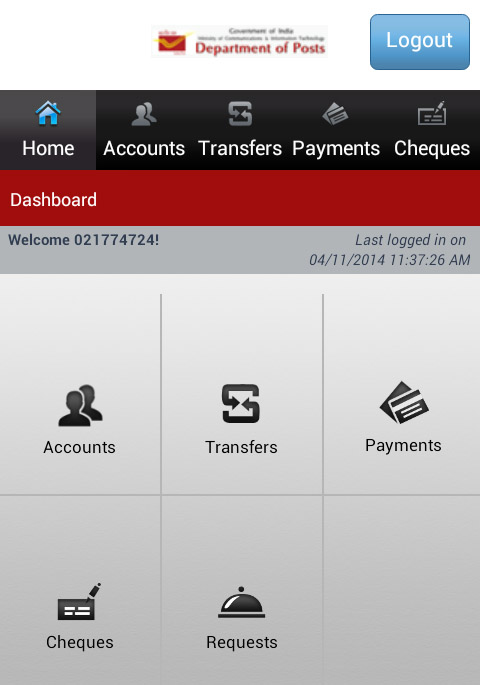

The services that can be used through post office mobile banking for your savings account are

- Checking Account Balance and Details – Saving, RD, LARD, TD, PPF, Loan Against PPF, NSC.

- Viewing Transaction History – Saving, RD, TD, PPF, Loan Against PPF, NSC.

- Availing Mini Statement – Saving, PPF.

- Fund transfer between your own savings account and other users savings accounts within DOP as well.

- Fund transfer from Savings accounts to your own or Linked RD and your own or Linked LARD Accounts.

- Fund transfer from Savings account to your own or Linked PPF (Subscription and Loan on PPF).

Now that we have covered all the points about activating internet banking, mobile banking for the post office, and its eligibility criteria. Also, you must have now understood the features of the internet baking and mobile banking services offered by Indian post, you can take advantage of this and carry out the tasks from your home. So just follow the steps mentioned above and you will be able to activate the mobile banking and internet banking services for your post office savings account with which you can now get access to all the services at any time and anywhere!