Everything about e-Rupee: What is e-Rupee | How use e-Rupee | How to register e-Rupee

We all know that India is on almost on the way to become a fully digitalised nation. The covid has changed the scenario completely. Online classes came into the picture. We also have been shopping online a lot. The payments percentage via mobile banking and net banking have incredibly increased over the past few years. Now we are finally stepping into a new era of digital currency or it is also called as ‘E rupee’. India has been working on e rupee since a really long time. The researchers have been researching how and about to go with fully digital currency. To get to know this concept better you have to understand what actually is e rupee.

What is e-Rupee?

The e Rupee is CBDC that is central bank digital currency. The currency that is available in digital form. Now this is exactly similar to physical currency. To explain it better and in simple words you will be issued with the digital notes with the same denominations that are available in the physical form. Now we are almost at a point where we will not need to use physical currency or even carry a wallet around anymore. This e Rupee works on the blockchain technology and is kind of similar to cryptocurrencies. The entry of CBDC that is central bank digital currency will change our economy and how we look at money completely. This digital currency will be issued by the central government so it will be absolutely secure. But do not confuse mobile banking or net banking. The money in your e wallet will be exactly like the money you carry in physical form. And you can convert this digital currency in to physical form anytime you want whenever you need.

How to use e-Rupee?

The government of India has launched the trial of e Rupee that is e from the 1st of December 2022. But this phase one is only limited to four cities only and a few banks as the banks will play the role of intermediaries in this process. In pilot trial phase two this will be then extended to four cities more and even a few more banks.

Steps how you can use the e Rupee –

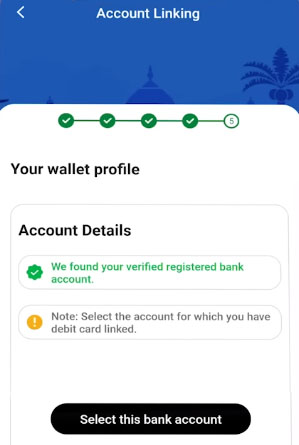

You will have to first install the CBDC app that is the central bank digital currency app from the play store. Then you will have to login.

You have to use the mobile number that is connected to your bank account.

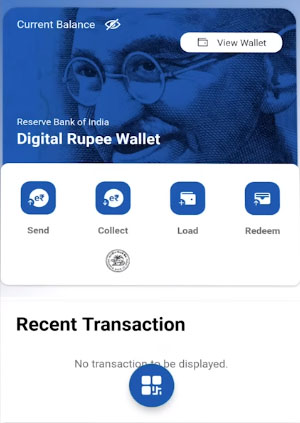

Once the registration process is completely done you will be assigned to your e wallet. You will also have a specific unique ID.

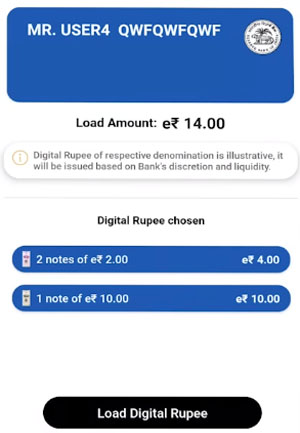

Now you can transfer the money from your bank account to your e wallet exactly like you would withdraw cash from the bank and load in into your physical wallet.

You will have notes of every denomination available in the physical form. So the denominations are Rs 5, 10, 20, 50, 100, 200, 500, 2000. Also you will also have digital coins from. You will have a limit to the amount you can have in your e wallet.

Now whenever you want to buy something you can use your e Rupee to pay with the merchants that accept this directly through your e wallet.

Now let’s take an example. You might have Rs 500. So you will have notes of different denominations in your e wallet. You will be able to view the denominations of notes that you have. So you might have a sum of four 100 rupee e notes and two 50 rupee e notes. So now when you go out and if you decide to buy something worth rupees hundred you can make the payment using your e rupee. So you will be shown the number of notes and their denominations. So you can choose to use two 50 rupee e notes or one 100 rupee e note.

So we looked at how you can use e Rupee. The pilot trial phase one is now started in four cities. The cities are

- Mumbai

- New Delhi

- Bengaluru

- Bhubaneshwar

The banks that are intermediaries in the pilot phase one are State Bank of India, ICICI bank, Yes bank and IDFC bank. In phase two this will be extended to more cites which are as follows

Ahmedabad, Gangtok, Guwahati, Hyderabad, Indore, Kochi, Lucknow, Patna, Shimla

The banks that will later on be added as the intermediaries in phase two are Bank of Baroda, Union bank of India, Kotak Mahindra Bank and HDFC bank. We really are hoping that these trials will result positively because this concept of e rupee has the superpower to completely transform our economy in the best possible way.