How to Check if your PAN has been Misused to take Unauthorised Loans

In today’s digital world, even famous people face problems. Actor Rajkumar Rao talked about a big issue. Someone used his PAN card to get a loan of Rs 2500. He didn’t know about it. Because of this, his CIBIL score got worse. This is a big problem that many people deal with. Someone can take a loan using your PAN Card without asking you. This could cause big money problems and make your credit history look bad. So, it’s really important for you to take action and keep your financial identity safe.

Regularly checking for active loans linked to your PAN Card becomes essential. This proactive approach allows you to report any suspicious or unauthorized activities promptly, preventing potential financial fraud. The added advantage is that if you identify any suspicious loans, you can take immediate action to report and close them.

This article will guide you, on how to find out if there are any loans connected to your PAN Card. We’ll also talk about how you can see your CIBIL score and loan history for free, which tells you about your money situation.

Check if your PAN has been Misused to take Unauthorised Loans

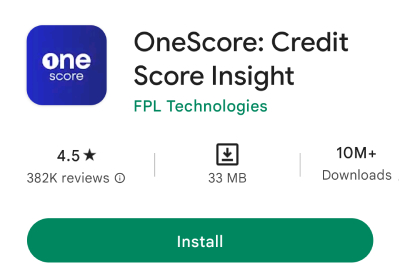

The Onescore app helps you to check your CIBIl score and loan history both under one roof. But for that, we will first have to register and create an account on the Onescore app. So let us move on and understand the process.

Step 1: Go to the Play Store or App Store and install the ‘Onescore app’ on your mobile phone.

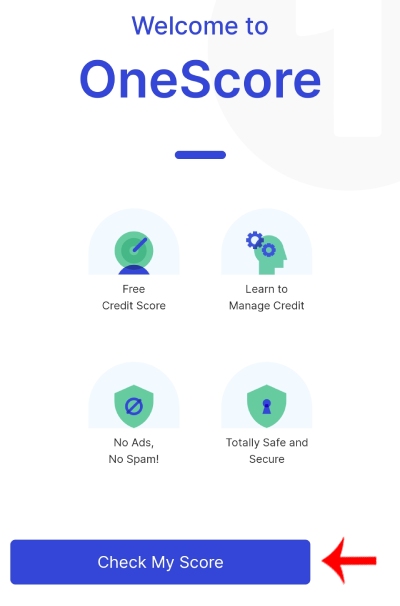

Step 2: Now once you launch the app you will see a ‘Check my score’ button on the screen. So click on this check my score button.

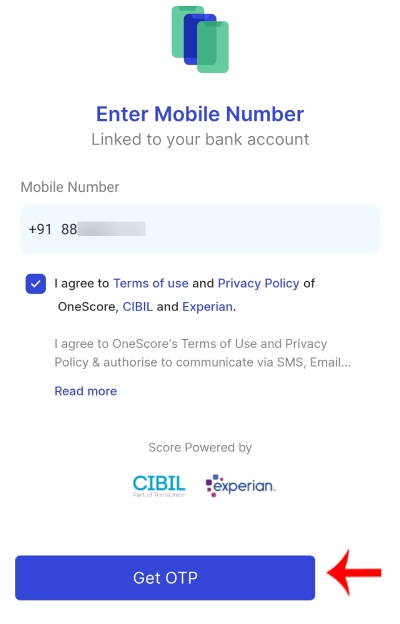

Step 3: Now here you will have to enter your mobile number. Then accept the terms and conditions by simply clicking on the check box and then you have to click on the ‘Get OTP’ button.

Step 4: You will now have to enter your personal details like first name, last name, and email ID. Once you have entered these details correctly just click on the ‘Continue’ button.

Now you will have to enter your PAN Card number and your date of birth. Then click on the ‘Continue’ button.

Step 5: Now in this step, you will have to enter your complete current address. This address should contain details like your plot number, PIN code, locality, landmark, area, etc. Once you have entered your address correctly you will have to click on the ‘Continue’ button.

Step 6: Now you will receive an OTP on the mobile number that you have previously entered. So enter the OTP that you have just received and then click on the ‘Done’ button.

You have now successfully completed the registration process on the Onescore app. You can now go ahead and check your CIBIL score and loan history.

Check your Cibil Score & Loan History

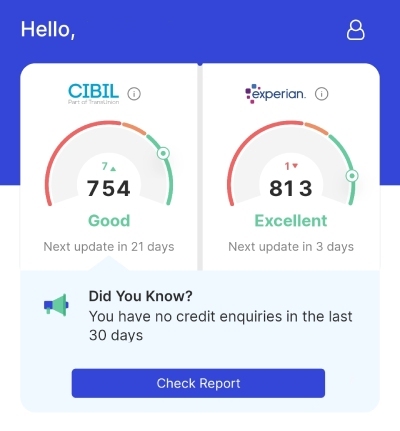

Step 1: Now that we have successfully registered on the Onescore app we will be redirected to the home page of this app.

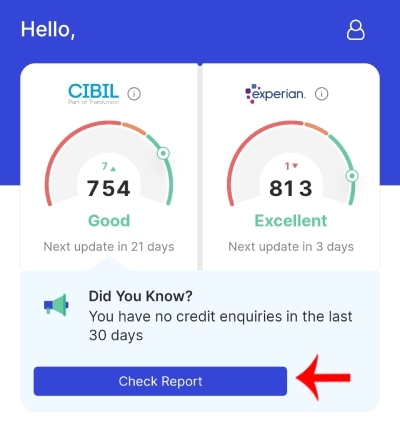

Step 2: On the home page you will be able to see your CIBIL credit score and your Experian credit score as well. If you want to check the full report of your credit score then you will just have to click on the ‘Check report’ button and your full credit score report will get opened.

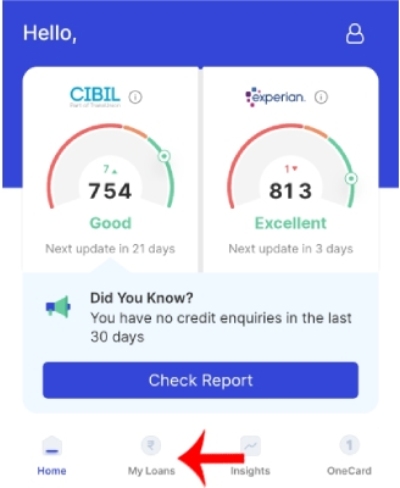

Step 3: Now in order to check your loan history you will have to click on the ‘My loan’ option present at the bottom of the screen.

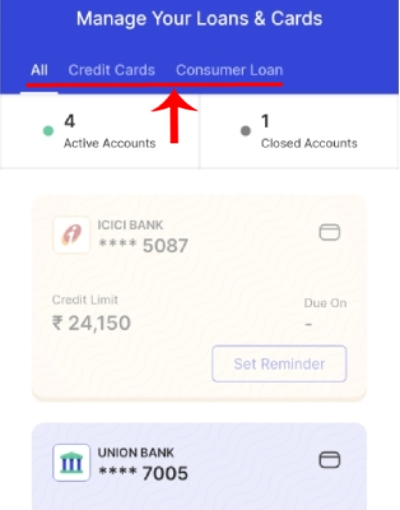

Step 4: Once you click on the My loan option, all of your active accounts and your closed accounts will be shown. Along with this, you will also be able to see how many active loans are there on your account.

So this is how you can easily check your CIBIL score and your loan history on the Onescore app.

Here are some additional things that you can check

- If you click on the ‘Credit card’ section you will be able to see all the active and closed credit cards in your name.

- If you click on the ‘Personal loan’ section you will be able to see all the active loans in your name.

- If you click on the ‘Consumer loan’ section then you will be able to see all of your active and closed consumer loans. If you avail of any ‘Pay later’ service from any company then they put this as a consumer loan under your name.

So this is how you can check all the closed as well as currently active loans under your name. If you want to check the details of any loan then all you have to do is click on that respective loan and the details will get opened.

So this is how you can easily report the loan if you find it suspicious. If you want to know all of your inquiry details then you will just have to click on the ‘Enquire your information’ section and all of the things that you have enquired will get opened.

Now we have covered the detailed step-by-step process to check your CIBIL score and loan history. Do not skip any step in order to avoid any problems. We hope that you found this article helpful and if you did do not forget to share this article with your friends and family so that even they can benefit from it.

FAQ

Is the Onescore app trustworthy?

Yes. The Onescore app is absolutely safe, secure, and trustworthy. The Onescore app does not share your data with any third party. So it is absolutely safe to use.

Do I have to pay any charges to use the Onescore app?

No. You do not have to pay any amount to use the Onescore app. You can use this app for free.

Does checking the credit score on the Onescore app affect my CIBIL score?

No. Just checking your CIBIL score on the Onescore app will not at all affect your credit score.