How to add Payee in Union Vyom app ? | How to add Beneficiary in Union Bank Vyom app ?

Whenever you make any payment online or any transaction there are always two parties involved. The first one is the ‘Payee’ and the second one is the ‘Payer’. To explain it further a payee simply refers to anyone who receives funds from a payer. The payment can take many forms, whether it’s a bank transfer, cheque, cash, or even the payments or transactions that you make using the mobile banking app. On the other hand, in return for submitting payment to the payee, the payer receives their goods and services in return. So a payee could be an individual, business, or even a trust. When you make payments or transactions online with the help of internet banking or mobile banking you have to provide the payee’s name and account details while you are setting up an electronic funds transfer.

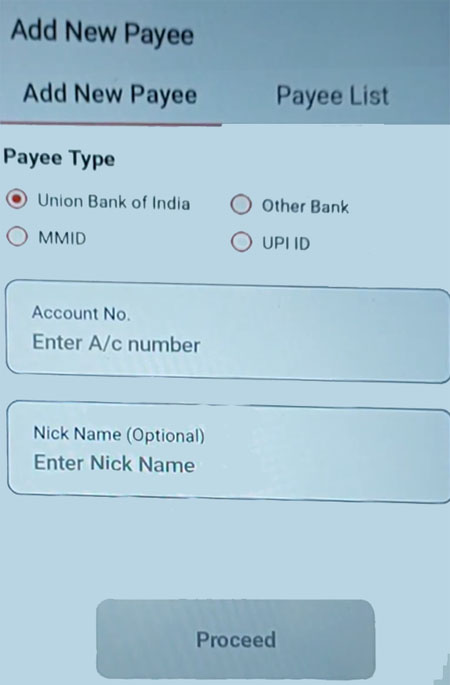

This payee information is used by the bank to determine where to send the money. For the system to work, a payee must have an active bank account with up-to-date details provided to the payer. So when you add a Payee using the Union Vyom mobile banking app you will get to select four types of the payee. So the four types of Payee options available are –

- Union bank of India

- Other bank

- MMID

- UPI ID

In today’s article, we are going to dive deep into the step-by-step process of how you can add Payee to your Union Bank account using the Union Vyom mobile banking app. So read this article till the end to completely understand how to add a payee in union bank of India in just in few minutes by using the Union Bank’s Vyom mobile banking app.

How to add Payee in Union Vyom app

Here are the steps to add a Payee in the Union bank of India using the Vyom mobile banking app-

Step 1: Launch the Vyom app on your phone. Log in to your account by entering your four digit log in pin.

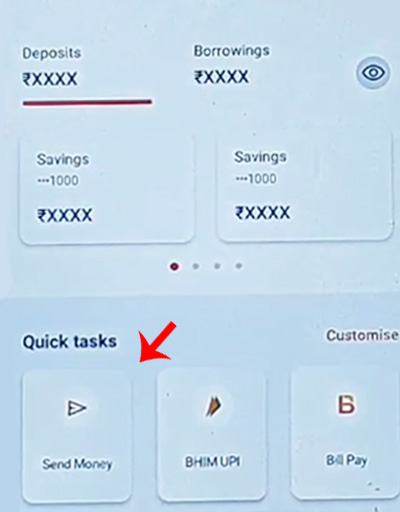

Step 2: Now from the Quick tasks column, choose the ‘Send money’ option.

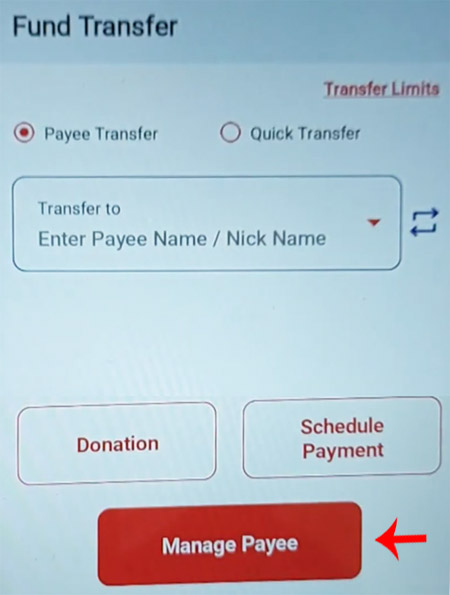

Step 3: Then you will have to click on the ‘Manage Payee’ option.

Step 4: Now under the Payee type select the ‘Union bank of India’ or ‘Other bank’ or ‘UPI ID’ option.

Union bank of India Account Number Option – Enter the fifteen-digit account number. Then System will detect if the account number is accurate. If the account number is correct then the system will automatically generate its IFSC code and the Payee’s name.

Other bank Option – Enter the Account number, IFSC code, and account type.

UPI ID Option – Enter the UPI ID. Then the system will automatically verify whether entered UPI ID is correct or not. (If the UPI ID is correct then you will be able to see the respective person’s name and if it is incorrect then the system will automatically show it as ‘Invalid’)

You can also add a nickname for the Payee. (This step is not compulsory) and then click on the ‘Proceed’ button.

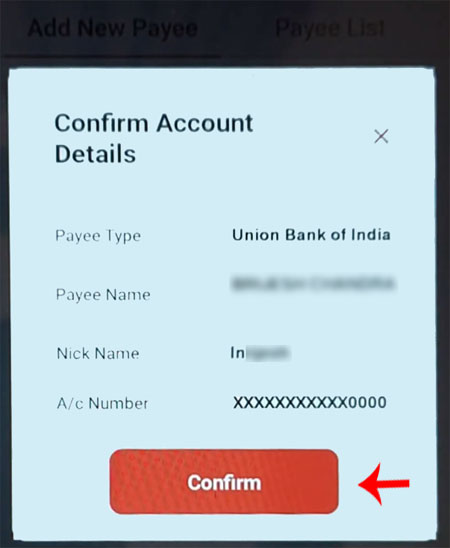

Step 5: Now the confirmation interface will be opened where you have to go through and check all the details and then click on the ‘Confirm’ button.

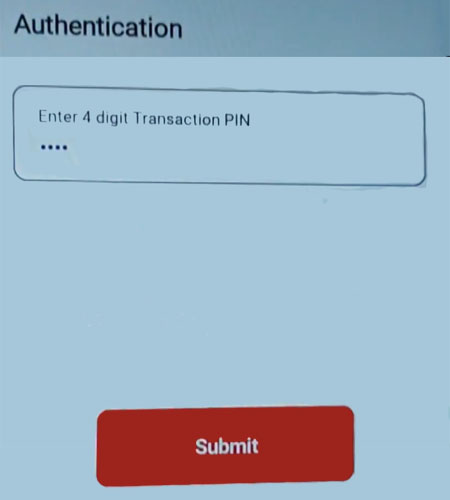

Step 6: Now you will have to enter your ‘Transaction pin’ as a part of the authentication process and then click on the ‘Submit’ button.

Read More: How to reset Union Vyom app Transaction Pin ?

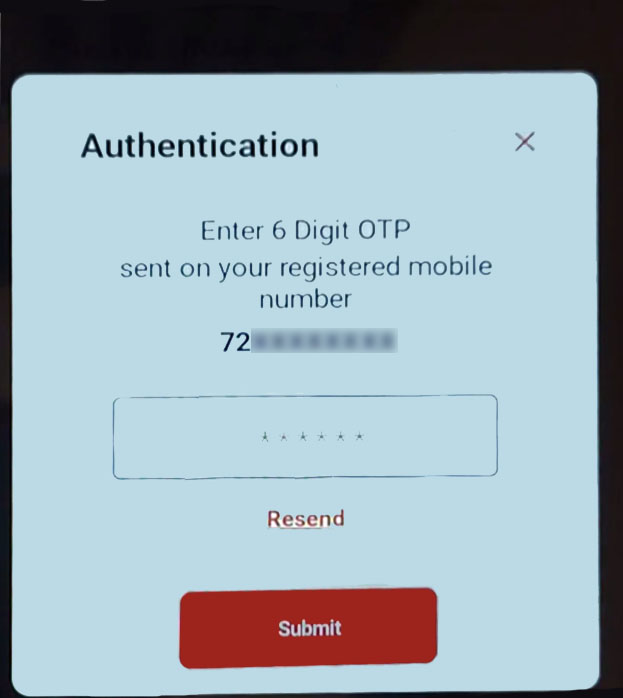

Step 7: You will now receive a six-digit OTP on the registered mobile number. Enter that OTP and then click on the ‘Submit’ button.

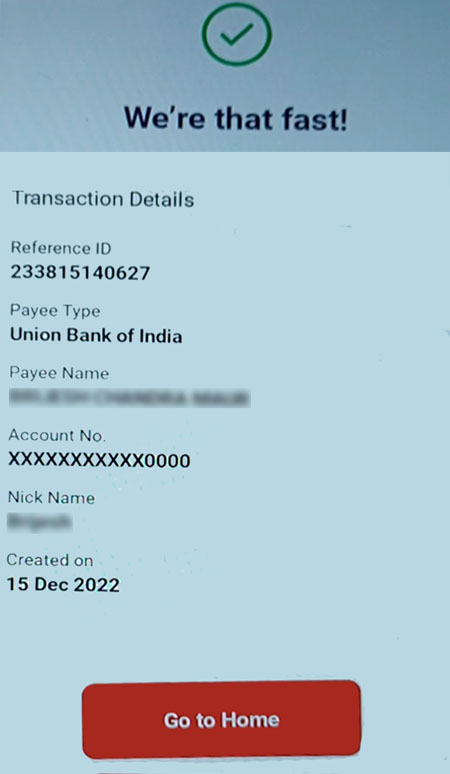

And you have successfully added a payee to the account in the Union bank of India.

This is how you can add a payee for the account in the Union bank of India using the Union Vyom mobile banking app. The registration process is a one-time activity. Beneficiaries are confirmed immediately at the time of registration using OTP and funds can be transferred after a cooling period of 24 hours.

Once the beneficiary is activated, the funds are transferred to the specified account. Depending on the mode of payment (NEFT, RTGS, IMPS) & the cooling period in the bank for beneficiary activation, the entire process of payouts can take up to 2 – 24 hrs. So make sure to follow all the steps mentioned above and you will be able to add a payee for the account in the Union Bank of India that too in less than five minutes using the Union Vyom mobile banking app without any obstacles!