How to Activate Bank of Maharashtra Mobile Banking for the First Time

The Bank of Maharashtra has enhanced the banking experience for its customers by offering them mobile banking services. So now by using the mobile banking service offered by the Bank Of Maharashtra you can carry out many tasks in the comfort of your home. So you will not have to visit your nearest branch often as you can get things done by sitting at home and that too at any time and anywhere. The Bank Of Maharashtra offers mobile banking services via its official mobile banking application that is named ‘Maha Mobile’.

This mobile banking app is available for both Android and iOS devices as well. You can carry out many banking activities at any time and anywhere using this app. So if you have an account in the Bank of Maharashtra you can take advantage of this mobile banking service. We will be discussing the entire step-by-step process to activate mobile banking for your account in the Bank of Maharashtra. So make sure that you read this article till the very end. All you have to do is just follow the step mentioned in the article below and you will be able to activate the mobile banking service easily without having to face any obstacles. So now let us proceed by first understanding the eligibility criteria for using the mobile banking service.

Who is eligible for the mobile banking service offered by the Bank of Maharashtra?

The mobile banking facility is available for people who have an active account in the Bank of Maharashtra. This is applicable for both savings and joint accounts. All types of savings bank account holders can take advantage of this mobile banking facility. Also, all the joint account holders operated on either or survivor basis are eligible too for accessing the mobile banking service by the Bank of Maharashtra.

Now that you have understood who is eligible for enabling the mobile banking services we will now move on to understanding the entire step-by-step process for activating the mobile banking service for your account in the Bank of Maharashtra. So just follow the steps given below carefully to avoid any mistakes.

Bank of Maharashtra Mobile Banking: How to Register, Log In & Set MPIN

Here is the detailed step-by-step process to activate mobile banking service for your account in the Bank of Maharashtra-

Step 1: Download the ‘Maha Mobile’ app from the Play Store or AppStore depending on the handset that you use.

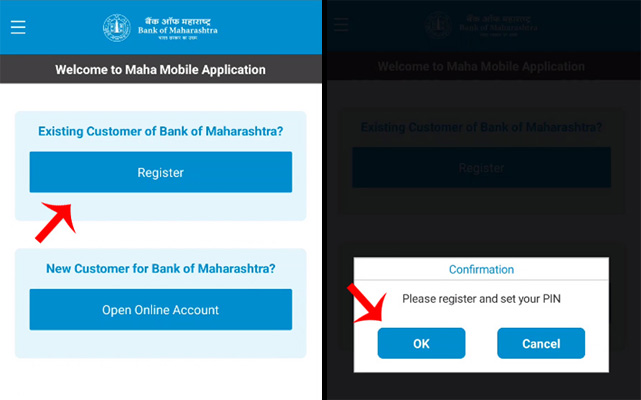

Step 2: Then click on the ‘Register’ option as you are an existing customer of the Bank of Maharashtra and then click on ‘Ok’ for confirmation purposes.

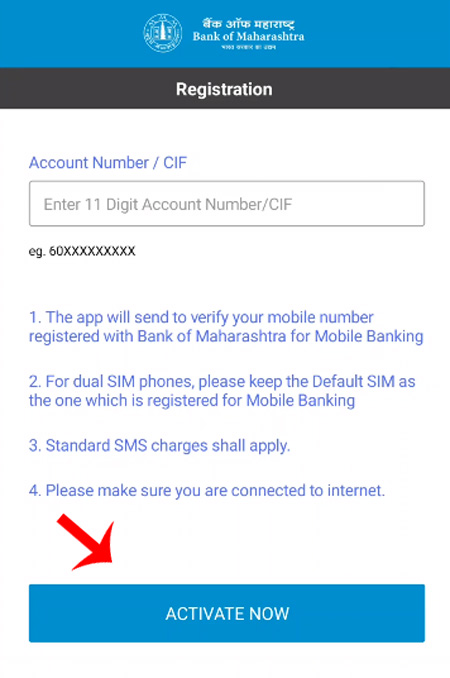

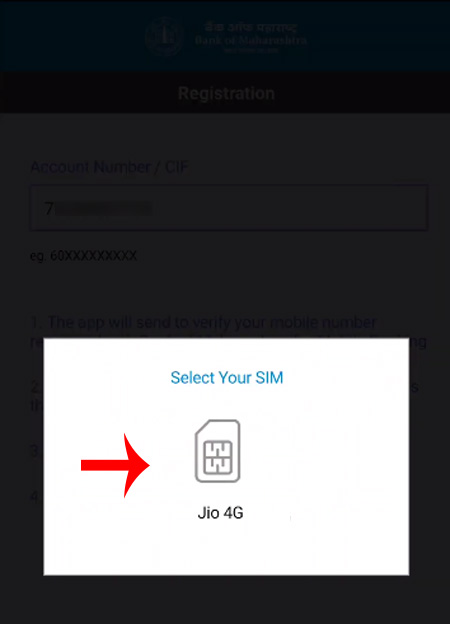

Step 3: Then you will have to enter your account number or your CIF number and then click on the ‘Activate Now’ button.

Step 4: Now under the ‘Selecting Sim’ option, choose the SIM number which is linked to your bank account.

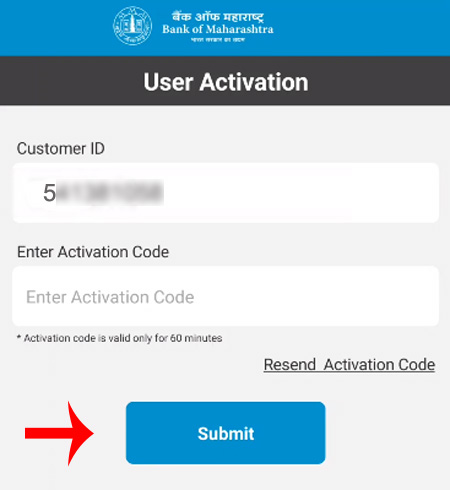

Step 5: Then you will receive a four-digit ‘Activation Code’ on your registered mobile number. Enter that code and then click on the ‘Submit ’ button.

Step 6: Now you will have to register.

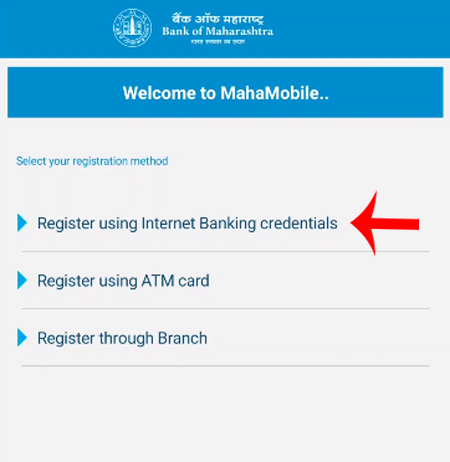

For registration, there are three methods which are as follows-

1) The first option is to register through internet banking. Registering through internet banking is the easiest way to register. In this article, we will choose the registering through the internet banking option. If you want to know how to register for internet banking then visit and read the article linked below for understanding the complete process. => How to Register for Bank Of Maharashtra Internet Banking

2) The second option is to register using an ATM card. For registering through your ATM card, you will have to enter your ATM credentials to complete the process.

3) The third option is to register offline by visiting the nearest branch of the Bank of India.

Now select and click on the Register using the Internet banking credentials option.

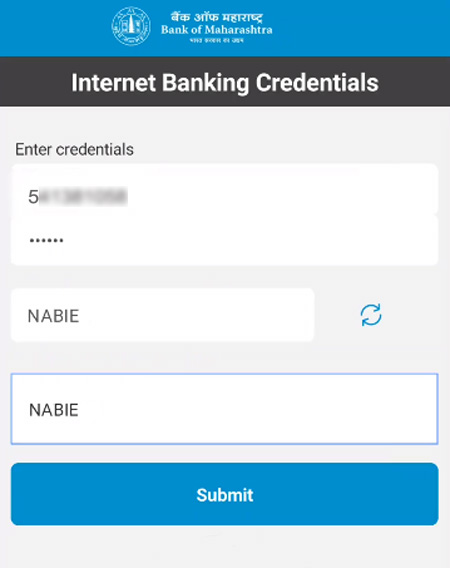

Step 7: Now you will have to enter your internet banking ID and password. You will then have to enter the captcha correctly and then click on the ‘Submit’ button.

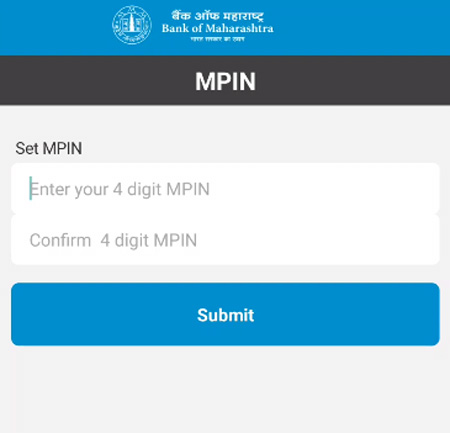

Step 8: Now you will see an option to set your MPIN. So now create and enter your MPIN (Enter the same MPIN twice for confirmation purposes) and then click on the ‘Submit’ button.

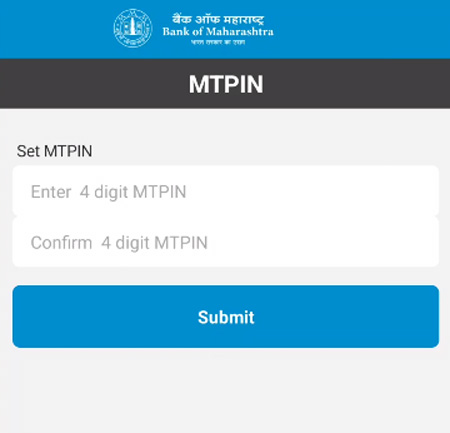

Step 9: Now you will have to create and set your MTPIN. So enter the four-digit MTPIN that you want to set. Then you will have to enter the exact same four-digit MTPIN again and then click on the ‘Submit’ button.

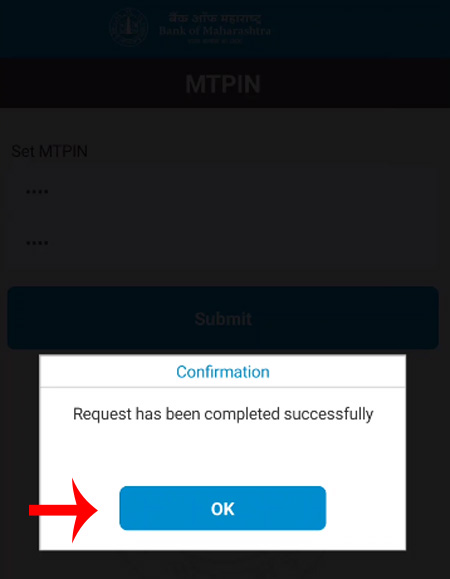

Step 10: And you have successfully activated the mobile banking service for your account in the Bank of Maharashtra!

So this is how you can activate the mobile banking service. the MTPIN is used for carrying out the transaction process. So make sure that you set a super strong MTPIN. It is advisable to not use code combinations like 0000, 1234, and 1111 as these code combinations are easy for hackers to crack. Also, avoid using birth dates and birth years. Make sure that you set an MTPIN that is easy to remember but hard to predict at the same time. If you notice any unusual or fraudulent activity then report it to your bank as soon as possible.

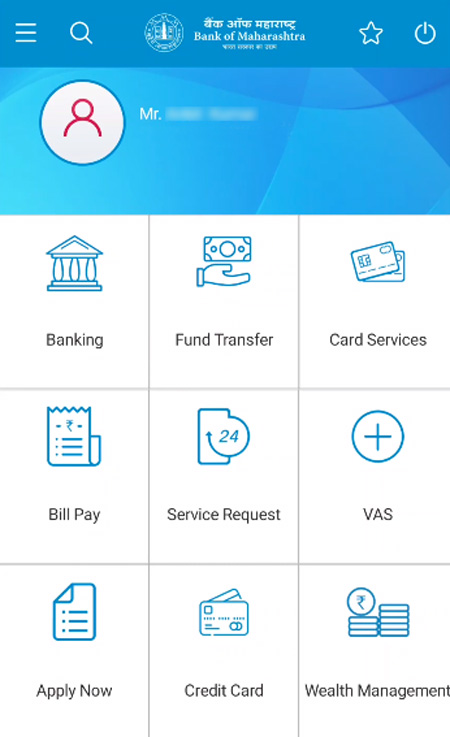

Once you have activated the mobile banking service you can now carry out tasks like checking your account balance. You can also download the mini statements using the Maha Mobile app. You can also carry out transactions to accounts within the bank or funds can be transferred to other bank accounts as well by using the NEFT facility or IMPS facility. The chequebook can also be requested using the mobile banking service via the Maha Mobile app.

The best part is currently there are no charges applied for the mobile banking application and no charges will be levied for transferring funds to other accounts within the Bank of Maharashtra. But if you transfer funds using the NEFT facility then some additional relevant services charges will be charged.

Also, you have to note that the transaction amount limit is Rs. 50,000 per day. And there is no transaction amount limit if you transfer funds to your own account. So these are the features and facilities offered by the Bank of Maharashtra via mobile banking. So what are you waiting for? Just follow the detailed step-by-step process mentioned in this article above and activate the mobile banking service at the earliest so that you will not have to stand in long queues and visit the branch often. You can carry out tasks in the comfort of your home that too at any time and anywhere. So follow the steps and activate the mobile banking service for your account in the Bank of Maharashtra and experience an enhanced banking service.